Q1 2024 Spot & Contract Truckload Rate Trends

In our last quarterly update, the Coyote Curve® continued it’s upward trend, digging out of the deepest trough in the index’s history.

Though it’s heading back towards inflation, the climb has been slow amidst slumping freight volumes.

The Q4 numbers are in.

Did we even have a peak season? Did it change the Q1 forecast? And when is 2024 rate inflation is coming?

We’ll tell you everything you need to know about the past quarter and what to expect throughout Q1 in the latest truckload market guide.

Q1 Truckload Market:

The Complete Guide for Logistics Pros

- Q4 Trucking Spot & Contract Rate Recap

- Economic Outlook: Indicators That Drive Freight Demand

- Trucking Trends Impacting the Market

- Q1 Truckload Market Forecast

- Watch the Forecast Webinar On Demand

- Download the Forecast Slides

New to the Coyote Curve?

These essential resources can help you build foundational knowledge on the truckload market and our proprietary spot rate index.

Q4 2023 Spot & Contract Trucking Rate Recap

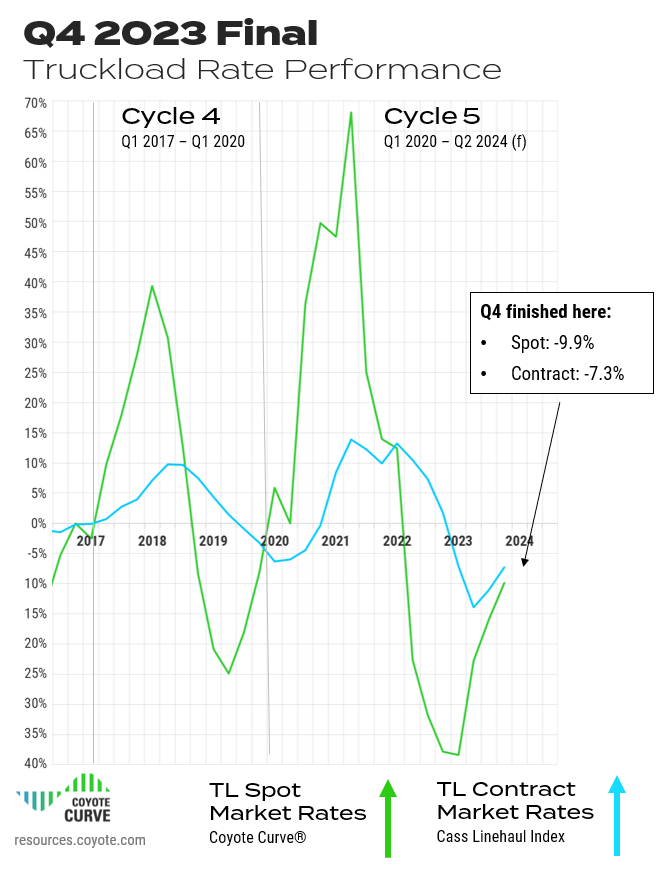

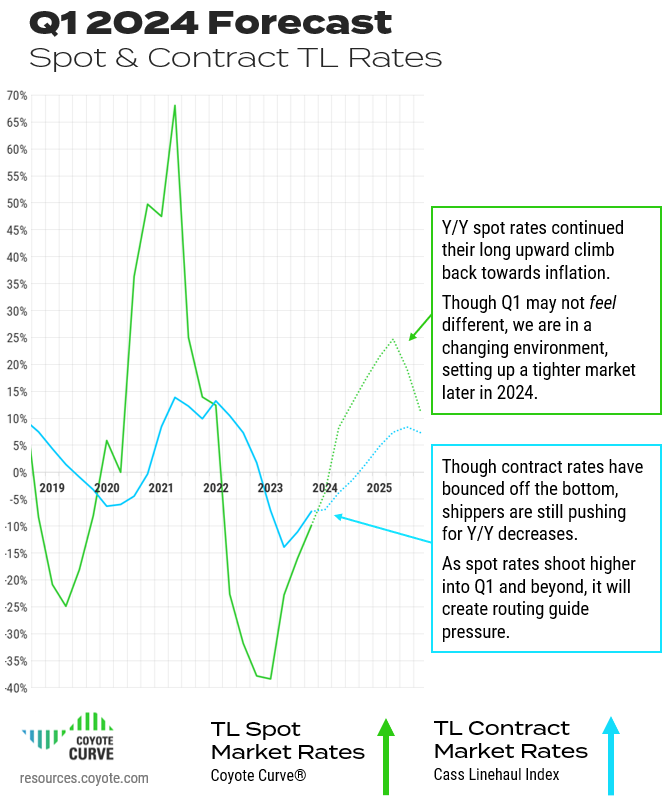

In Q4, the Coyote Curve continued its climb towards inflation, in-line with our prediction.

Y/Y spot rates may have trended upwards for the third straight quarter, but overall conditions remained relatively stable — neither shippers nor carriers likely noticed a significant impact to pricing and capacity.

Even the typical shipping bump from retail peak season was not enough to cause widespread disruption given our current place in the truckload market cycle.

But we are definitively off the bottom and rates are coming up.

Download all the forecast charts in slide format for your next presentation.

Q4 Truckload Spot Rates Continued Heading Towards Inflation

Truckload spot rates finished Q3 at -9.9% Y/Y, up from -16.0% in Q3.

Q4 Truckload Contract Rates Have Bounced Off the Bottom

Truckload contract rates* trended upwards to -7.3%, up from -11.1% Y/Y in Q3 2023.

Typically contract rates will lag spot rate activity by two to three quarters, but the turn happened faster in this cycle, lagging by only one quarter.

This was driven by record decreases in contract rates — there was just not any further down to go.

Once again, contract rates stayed ahead of spot rates, but only barely. They narrowed to their lowest gap since they crossed in Q1 2022.

These indices will (almost certainly) cross paths in Q1, which will begin to create pricing and capacity pressure on shippers as carriers look for long-awaited spot premiums to make up for a historically tough down market.

As the two diverge further into 2024, this will increase routing guide deterioration.

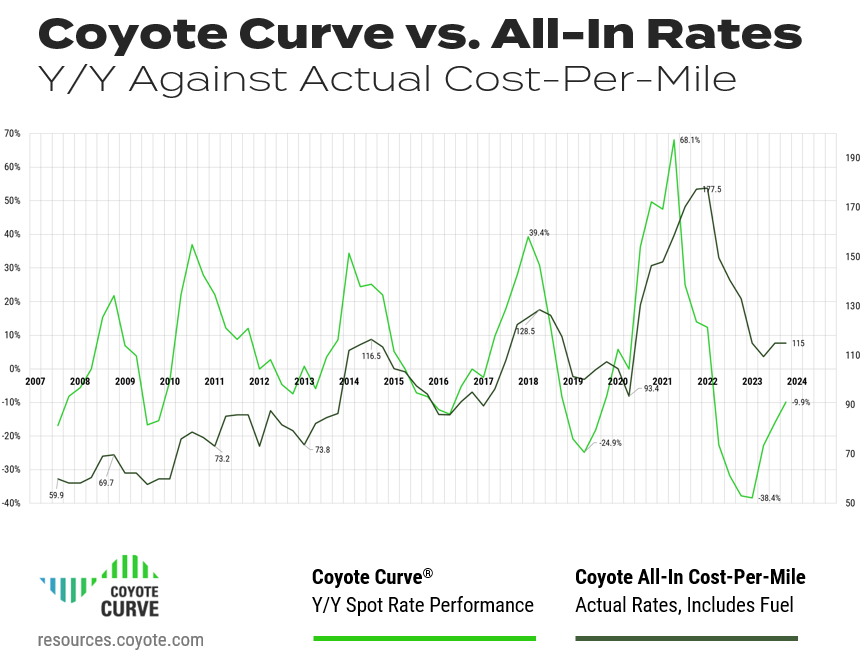

All-In Spot Truckload Rates vs. Y/Y

To build further confidence in the Coyote Curve Y/Y spot rate index, let’s see it up against our proprietary all-in cost-per-mile index — this is comparing annual change versus the absolute rate.

(As a reminder, these numbers are informed by real transactional data from thousands daily shipments spanning over 16 years.)

Download all the forecast charts in slide format for your next presentation.

In Q3, we saw all-in rates increase sequentially for the first time since Q1 2022.

In Q4, all-in rates remained flat, and our all-in index stayed at the same level.

Though the cost-per-mile index is also off the bottom, it’s still only back to levels from the 2014 peak.

That means, in absolute terms, carriers are currently getting similar spot rates to nine years ago, though their operating costs (diesel, insurance, labor, etc.) have increased substantially.

Simply put, there was no room for rates to drop, as many carriers were (and still are) running at unsustainable levels.

Q4 2023 Truckload Market Recap

The Coyote Curve (measuring Y/Y change in spot rates) continued its upward climb for the third straight quarter, though all-in rates (actual amount paid to carriers) remained flat, after increasing in Q3 for the first time in five quarters.

Signs continued to point upwards, but we were still well within a shippers’ market, and carriers remained under significant cost pressure.

Shippers enjoyed high tender acceptance, easy capacity and limited increases in rates throughout a traditionally busy peak season.

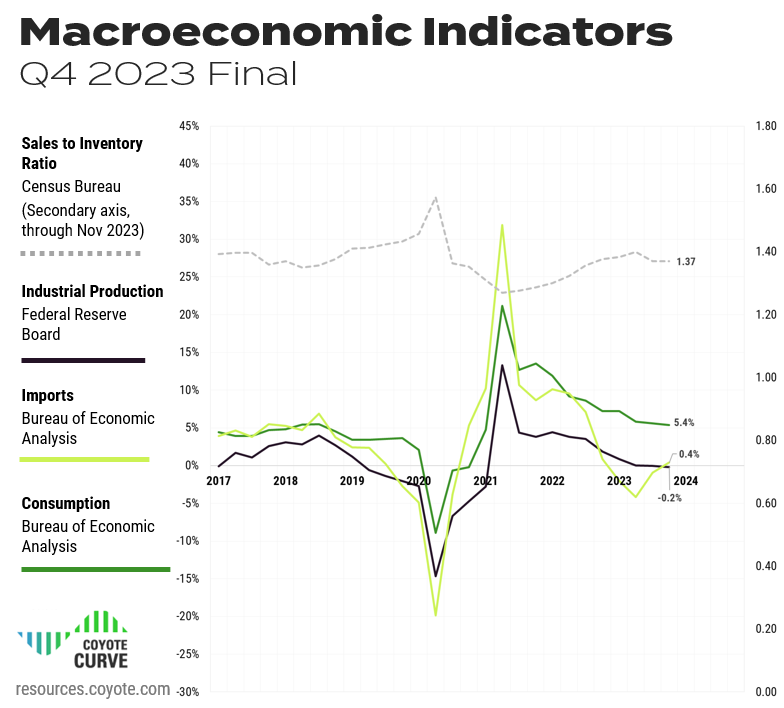

Key Economic Indicators Driving the Truckload Market

Throughout 2023, the burning question was, “Is the U.S. economy going to tip into a recession, or will we have a soft landing?”

As we get into 2024, the base case seems to be soft landing, and though some headwinds persist (inflation, slowing production, slowing imports), once again the economy keeps chugging along, buoyed by consumer spending and employment.

Freight markets, however, have been a different story; in terms of overall shipping volume, we are still in a recessionary period.

It’s worth noting that though the truckload market is linked to what happens in the wider economy, it is not always coupled (see the inflationary Curve in 2008 during the Great Recession).

Given how supply and demand work in the truckload market, it’s possible for the economy to remain strong and the truckload market to languish (and vice versa).

Let’s examine the most recent available figures for industrial production, consumer spending, imports and inventories through the lens of how they are impacting truckload shipping.

Download all the forecast charts in slide format for your next presentation.

Personal Consumption Expenditures

- What is it?

How much the American consumer is spending - How it impacts truckload shipping:

The more we buy, the more we need to produce (IP) and/or buy elsewhere (imports), which translates to greater demand for truckload shipping.

Despite persistent inflation and fears over a possible recession, consumer spending has remained stable, helping to buoy the overall economy.

Though the rate of growth has steadily slowed since Q4 2021, it is still growing — PCE finished Q3 at 5.6%, and remained virtually flat in Q4, closing at 5.4%.

Industrial Production (IP)

- What is it?

Total value of physical goods America is producing - How it impacts truckload shipping:

The more we make, the more freight that needs to move, from raw material inputs to finished goods

Though IP, like consumer spending, has trended downwards for several quarters, it is still stable. The index closed Q3 at -0.04% Y/Y, and remained virtually flat in Q4, closing at -0.2%.

Throughout 2023, many shippers tried to decrease the high inventory levels they built up after pandemic-era supply chain shortages. If their efforts prove successful, it will help spur increased production in 2024.

While we don’t anticipate a large uptick (that would increase overall truckload volumes), as long as it remains stable, demand won’t likely get any worse either.

Imports (Goods Only)

- What is it?

Total value of physical goods America is buying from other countries - How it impacts truckload shipping:

The more we buy from other countries, the more freight that needs to move, from raw material inputs to finished goods

With chaos in international shipping markets over the past four years, this indicator has been particularly volatile.

After hitting a high of 31.9% in 2021, imports (of goods, excluding services) ended Q3 at -0.9% Y/Y, and trended back into Y/Y positive territory in Q4, ending at 0.4%.

Though Y/Y imports have been dropping, the rate of decline has levelled off significantly, and once the Q4 figures (with peak season retail shipping) are in, we may see a reverse of the trend.

Inventory-to-Sales

- What is it?

The ratio of physical goods businesses have in stock vs. how much they’re selling - How it impacts truckload shipping:

When inventory levels are high, it creates a delay in demand for truckload shipping, as businesses will work off excess inventory before producing new goods (IP) or buying more goods (imports).

After pandemic-related supply chain disruptions wrought havoc to shippers’ inventories, many began to stockpile in an effort to combat volatility and meet demand.

Throughout 2023, many businesses tried to shed inventory amidst falling demand and rising interest costs, yet the ratio increased for the seven out of the past nine quarters.

However, it looks like Q3 may have been the turn of the tide, with the index trending down slightly (1.37).

Through November (most recent available), the index held at 1.37, and may fade lower further into the quarter with peak season shipping.

Four consecutive months of decline is good news for freight markets, suggesting that destocking efforts are taking hold, setting us up for potential restocking in 2024 (i.e., more truckload shipping).

Macroeconomic Takeaway

Despite continued headwinds throughout 2023, the U.S. economy seems to have stubbornly avoided a recession.Though we are still coming out of a freight recession, the truckload cycle will continue its course.

The last time the cycle went inflationary (2020 – 2021), incremental freight demand drove rate growth. For the upcoming inflationary leg, the macroeconomic outlook still doesn’t support a massive spike in demand.

Instead, supply-side constraints (carrier attrition) will be the driving force.

Truckload Market Trends to Watch in Q4

We have climbed out of the trough of the truckload market cycle and are heading back towards Y/Y inflation.

Exactly when we get there depends on a few different factors.

Let’s unpack a few of the key trends impacting the market before we dive into the updated Q1 forecast.

1. Freight volumes are (still) lagging.

Though we may not be in an economic recession, we are in a freight recession, at least in terms of truckload shipping volumes.

Even peak season shipping failed to cause a material uptick in truckload volumes throughout Q4. Both the Cass Shipment Index and ATA Truck Tonnage Index are showing Y/Y decreases.

A strong retail-driven peak season would have driven a faster bounce back to inflation, but the continued move upward in the truckload market cycle is likely going to be supply-driven.

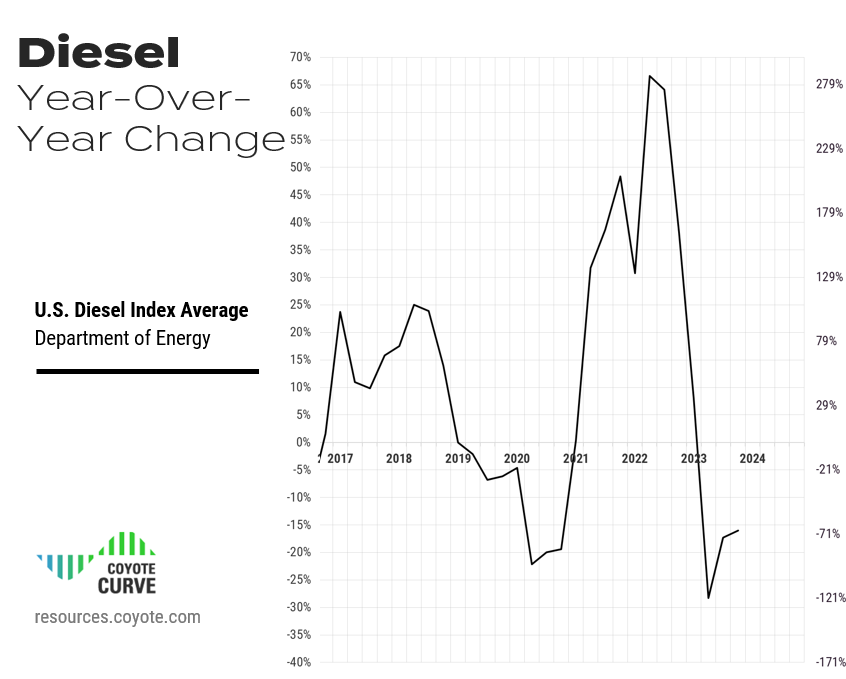

2. Fuel prices are stable.

After historically high diesel rates in 2022, most of 2023 saw a significant drop.

However, Q3 was tough on carriers. Though fuel was down -17.3% Y/Y, it shot up to $4.56 in September — an 18% increase over the course of the quarter, far outpacing all-in spot rate growth.

Fortunately for carriers, Q4 brought more stability — diesel started Q4 at $4.6/gallon, but ended at $3.90, down -16% Y/Y, and -0.5% compared to Q3.

Why does that matter?

Diesel fuel, which represents around 30% of a carrier’s overall cost, can have a huge impact on a trucking company’s profitability if it rises or falls faster than freight rates.

Many carriers were able to absorb historically high fuel costs in 2022 due to historically high rates. That is no longer the case.

If fuel gets more expensive, we’ll see a faster rise to inflation as carriers can no longer absorb the increase. If it remains stable, expect a slower rise.

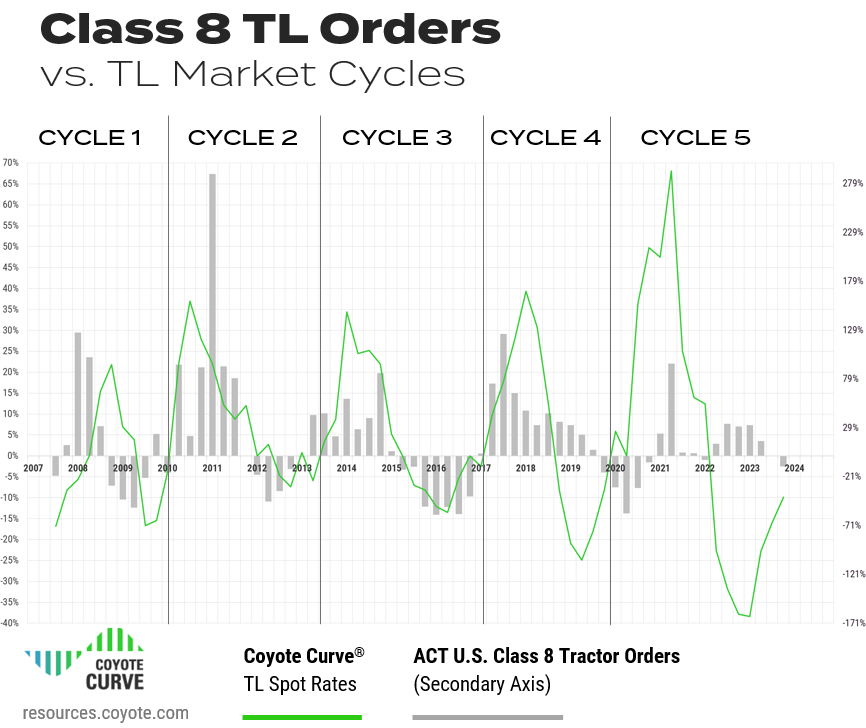

3. Carriers are buying less trucks.

In Q2, Class 8 tractor orders (as tracked by ACT Research) were up 15% on a Y/Y basis, and even up 11% sequentially (Q1 vs. Q2) — both of which were atypical for this point in the cycle.

Spot rates had been dropping for over a year, which historically leads to a decline in orders.

In Q3, we finally saw this register in orders, and the index finished at 0.7% Y/Y.

In Q4, we saw the bottom fall out, with orders trending negative for the first time since Q1 2022, dropping to -10.6%.

This is another indicator showing the financial strain on the supply base — carriers have caught up to COVID-era backlogs, and the need for incremental capacity, or the ability to turn over old equipment, is lessening.

4. Spot and contract rates will (finally) converge.

Most shippers used their 2023 transportation RFP as an opportunity to bring their contract rates back towards pre-pandemic levels.

Carriers that had been running freight on contract (or primary) rates were netting a significant premium to the spot market, and that continued throughout (almost) all 2023.

At the end of Q4, the cracks began to show.

For the first time in two years, we saw spot freight move at a premium to contract in the weeks surrounding Christmas.

While the traditionally slower shipping month of January may mean a dip back down, don’t expect that to last.

Heading into their 2024 transportation RFPs, most shippers are going to procure contract truckload rates at a decrease to their 2023 bids. As 2024 RFPs begin to set in, the spot market will become more lucrative than the contract market, both in Y/Y and absolute terms.

As the two diverge, it will create tension across routing guides as carriers look to move more drivers into the spot market. We’ll see the shift from a shipper’s market back to a carrier’s market begin.

5. Carrier employment is waning.

Throughout most of 2023, driver employment was curiously strong, despite weaker freight volumes.

But in Q4, we finally started to see more attrition.

While it’s difficult to get a complete picture of the massive and fragmented carrier base (owner-operators don’t show up in payroll data), we can use a few different data points to illustrate the trend.

- The November jobs update (most recent available) for Truck and Transportation employment from the Bureau of Labor Statistics (BLS) posted an increase of ~700 total jobs from the month prior. While a slight increase from October, it’s a 1.5% Y/Y decrease (roughly 25,000 trucking jobs).

- The BLS also publishes data specific to long-distance over the road drivers. This data lags by about a month, but the October update showed -4% Y/Y decrease in the long-distance driver population.

- The Department of Transportation (DOT) tracks carrier operating authority revocations, and over the last year (according to the most recent October reading) we’ve seen a sustained trend of more authorities revoked than granted. The 3-month moving average has been ~3,200 monthly net revocations.

Why Hasn’t the Market Felt It Already?

When spot rates were hitting all-time highs in 2021 and 2022, many drivers opted to become owner-operators or drive for smaller fleets heavily exposed to spot market freight (since it paid more).

In 2023, the tables turned, and many smaller carriers without access to more lucrative contract freight lost drivers to larger fleets with more stable, consistent work.

This held up the driver employment figures, and allowed large private fleets and national for-hire carriers to aggressively compete for limited freight. But that trend is waning — most large fleets have the drivers they need to support their current freight volumes.

With that understood, we can safely assume that capacity is no longer just shifting around from small carrier to large carrier, it’s exiting the market.

Truckload Trends Takeaway

Though freight volumes are sluggish, there are signs of carrier attrition in employment and authority revocations.

The speed and severity of the upward climb will depend on how fast carrier capacity exits the market.

Q1 2024 Truckload Market Forecast

We’ve covered the macroeconomic environment, and key trends — but where does it leave us going forward?

Let’s look at the latest forecast.

Download all the forecast charts in slide format for your next presentation

We predict the Coyote Curve will continue it’s move to the upside and get close to equilibrium.

In Q4 2023, we thought Q1 2024 would be the flip back to inflationary. While that may still happen, the move up might be a little slower given the persistently sluggish environment, and we now think Q2 will be the official entry back to inflation.

Regardless, we are in a changing environment, and though Q1 might not feel different, capacity and rates are stabilizing.

We are seeing carrier capacity leave the market, truckload rates are clawing higher, and stable consumer spending supports a rosier freight demand outlook in 2024.

As bid rates reset in early 2024 (most of them flat or lower), and spot rates trend higher, the divergence will drive volatility as cash-strapped carriers look to increase profitability after a very difficult 2023.

All that said, while the index will certainly flip inflationary this year, we don’t anticipate the sort of extreme conditions experienced in the last inflationary market in 2020 and 2021. For guidance, a look back to 2017 would be a better comparison.

Forecast Takeaway

We continue to head back to an inflationary spot market, which we will likely hit in Q2 (maybe even Q1).Contract rates, though trending upwards, will likely remain in Y/Y deflationary for several more quarters. As 2024 bids set in, spot rates will overtake contract, creating pressure for shippers.

While Q1 might not feel like a dramatically different operating environment, we are in a changing environment that is setting us up for a flip later in the year.

What Can You Do?

Now is the time to maximize planning and communication with your core freight providers.

Though tempting, shippers need to be prudent about where you’re cutting rates and trimming capacity — we believe 2024 will look different than the past several quarters.

Short-term gains today could cost you in the spot market tomorrow.

Want to Know How Your Peers Are Working With Providers?

You can get insights from 500 shippers with our research study on supply chain outsourcing.

Read The Outsourcing Study Now

Watch the Q1 Forecast Webinar

This forecast aired during our Supply Chain Master Series in late December.

Watch experts break down the state of the freight market in this on-demand session.

Continued Learning: Truckload Market 101

These three helpful resources will help you learn about truckload market fundamentals and how we build our proprietary index.

If you’re new to the Coyote Curve, take a few minutes to familiarize yourself with this foundational content:

Part I: Supply & Demand 101: Basics of Truckload Market Economics

Part II: Understanding the U.S. Truckload Market

Part III: Explaining the Coyote Curve

*We use the Cass Truckload Linehaul index as a proxy for contract rate performance.