Q4 2023 Spot & Contract Truckload Rate Trends

In our last quarterly update, we finally saw the Coyote Curve® index bounce off the bottom, trending upwards for the first time in two years.

Did the U.S. truckload market continue its climb back towards inflation, or reverse course amidst lagging freight demand?

The Q3 numbers are in.

We’ll tell you everything you need to know about the past quarter and what to expect throughout Q4 in the latest truckload market guide.

Q4 Truckload Market:

The Complete Guide for Logistics Pros

- Q3 Trucking Spot & Contract Rates Recap

- Economic Outlook: How Indicators Are Driving Demand

- Trends Impacting the Market in Q4

- Q4 Truckload Market Forecast

- Download the Forecast Slides

New to the Coyote Curve?

These essential resources can help you build foundational knowledge on the truckload market and our proprietary spot rate index.

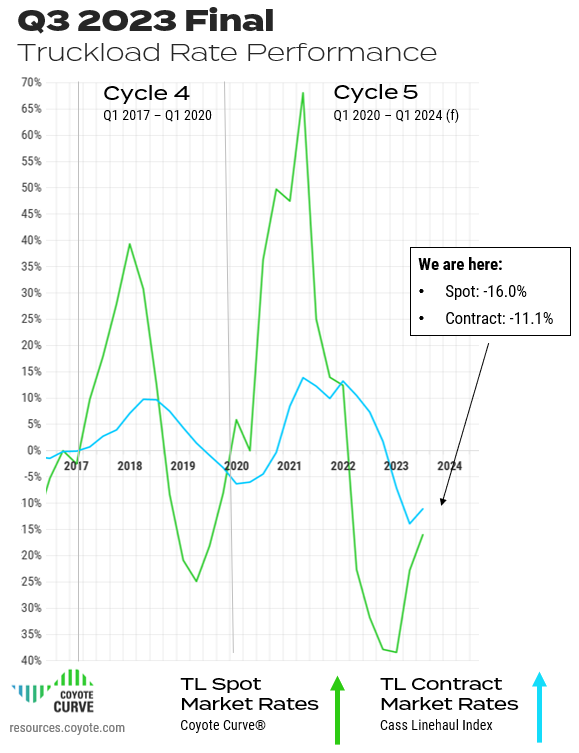

Q3 2023 Spot & Contract Trucking Rate Recap

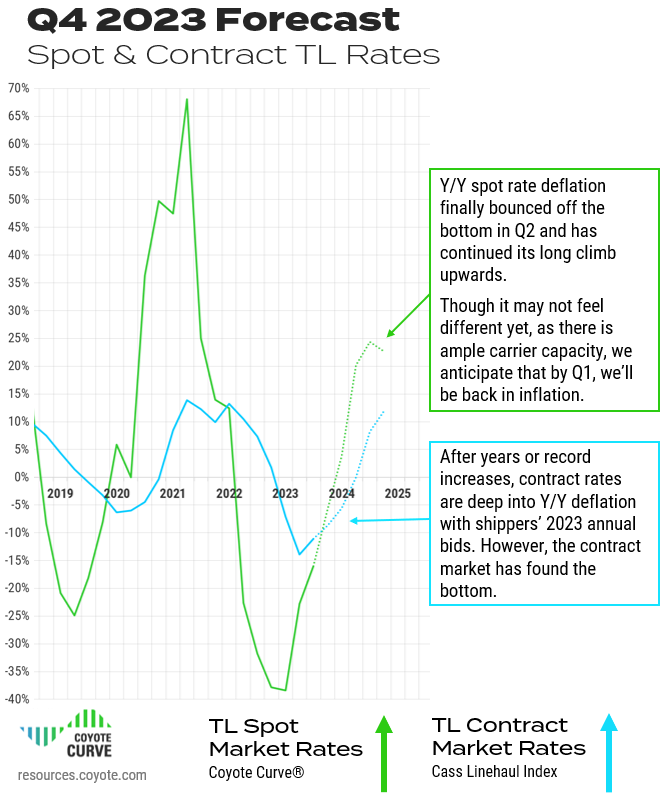

In Q3, the Coyote Curve continued its climb towards inflation, in-line with our prediction.

Y/Y spot rates may have trended upwards for the second straight quarter, but overall conditions remained relatively stable — neither shippers nor carriers were likely to notice a significant impact to pricing and capacity.

Despite the typical seasonal shipping events (4th of July, back-to-school, Labor Day, peak season build up) and a couple of unplanned ones (Hurricane Idalia, the closing of Yellow), it was not enough to cause disruption given our current place in the truckload market cycle.

Let’s take a closer look at the final results.

Download all the forecast charts in slide format for your next presentation.

Q3 Truckload Spot Rates Continued Heading Towards Inflation

Truckload spot rates finished Q3 at -16.0% Y/Y, up from -22.8% in Q2.

Q3 Truckload Contract Rates Have Bounced Off the Bottom

Truckload contract rates* trended upwards to -11.1% Y/Y, up from -13.9% in Q2 2023.

Typically contract rates will lag spot rate activity by two or three quarters, but the turn happened faster in this cycle, only lagging by one quarter.

This was driven by the record decreases in contract rates — there was just not any further down to go.

Though spot rates will likely increase at a faster pace than contract in Q4, and these lines will likely cross, it won’t create too much pricing and capacity pressure on shippers in the near term.

As the two diverge further into 2024, that may start to change.

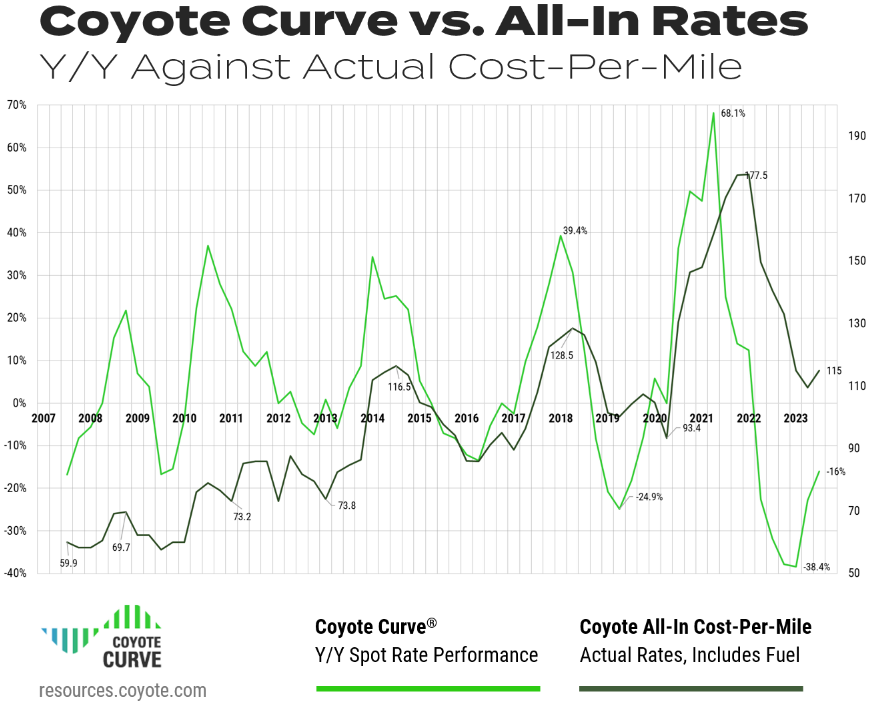

All-In Spot Truckload Rates vs. Y/Y

To build further confidence in the Coyote Curve Y/Y spot rate index, let’s see it up against our proprietary all-in cost-per-mile index — this is comparing annual change versus the absolute rate.

(As a reminder, these numbers are informed by real transactional data from thousands daily shipments spanning over 15 years.)

Download all the forecast charts in slide format for your next presentation.

In Q3, we saw all-in rates increase sequentially for the first time since Q1 2022, though we’re still only back to levels from the 2014 peak.

That means, at an aggregate level, carriers are currently getting paid similar spot rates to nine years ago, though their operating costs (diesel, insurance, labor, etc.) have increased substantially.

Simply put, there was no more room left for rates to drop, as many carriers were (and still are) running at unsustainable levels. Furthermore, the price of diesel rose substantially throughout Q3 (more on that below).

Q3 2023 Truckload Market Recap

The Coyote Curve (measuring Y/Y change in spot rates) continued its upward climb for the second straight quarter, and all-in rates (actual amount paid to carriers) increased for the first time in five quarters.

Though signs pointed upwards, we were still well within a shippers’ market, and carriers remained under significant cost pressure.

Shippers enjoyed high tender acceptance, easy capacity and limited increases in rates.

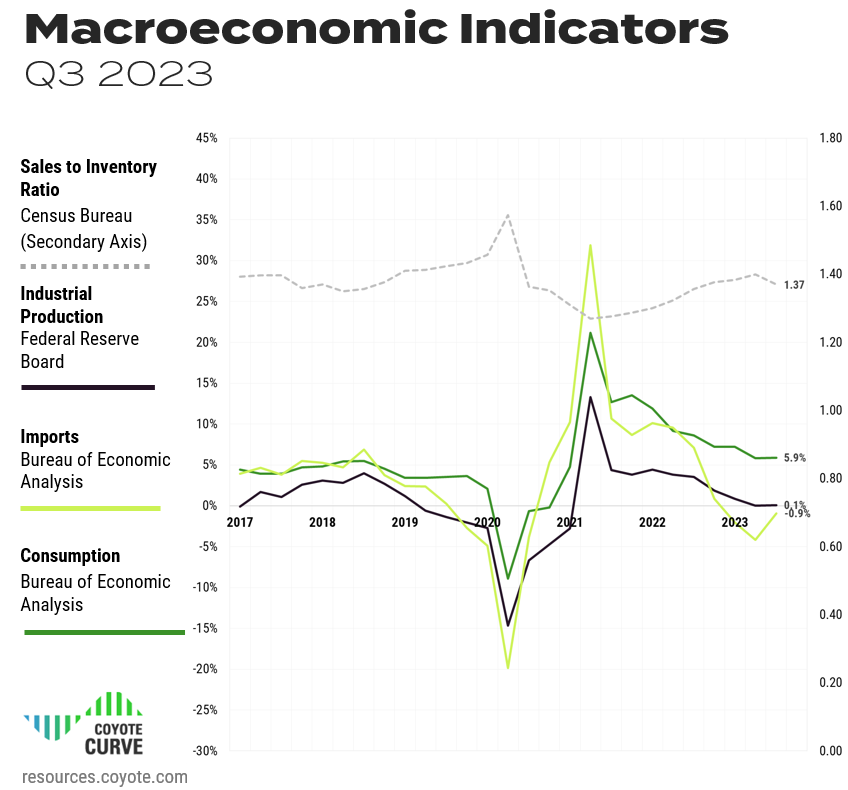

Key Economic Indicators Driving the Truckload Market

For the last several quarters, the burning question has been, “Is the U.S. economy going to tip into a recession, or will we have a soft landing?”

Though headwinds persist (inflation, slowing production, slowing imports), the economy keeps chugging along, buoyed by consumer spending and employment.

Freight markets, however, are a different story; in terms of overall shipping volume, we are in a recessionary period.

Much of this is driven by a continued consumer shift away from goods (where Americans spent during the pandemic) back to services, as well stubbornly high inventories (more on that below).

It’s worth noting that though the truckload market is linked to what happens in the wider economy, it is not always coupled (see the inflationary Curve in 2008 during the Great Recession).

Given how supply and demand work in the truckload market, it’s possible for the economy to slow and the truckload market to continue inflating.

“The good news is, we’re not forecasting a recession. Our baseline forecast now is that the U.S. has managed to escape, we’re going to see slow growth, even slower growth than we had this year, but we’re not going to be in a recession”

Paul Bingham

Director, Transportation Consulting

S&P Global Market Intelligence

Presenting in the Q4 Supply Chain Master Series

Let’s examine the most recent available figures for industrial production, consumer spending, imports and inventories through the lens of how they are impacting truckload shipping.

Download all the forecast charts in slide format for your next presentation.

Personal Consumption Expenditures

- What is it?

How much the American consumer is spending - How it impacts truckload shipping:

The more we buy, the more we need to produce (IP) and/or buy elsewhere (imports), which translates to greater demand for truckload shipping.

Despite persistent inflation and fears over a possible recession, consumer spending has remained stable, helping to buoy the overall economy.

Though the rate of growth has slowed (Y/Y spending has declined for seven of the past eight quarters), it is still growing — PCE finished Q2 at 5.8%, and 5.9% in Q3.

It is worth noting that most of the growth was driven by spending on services, while goods spending (which has a bigger impact on the amount of freight shipping) has been virtually flat for most of the year.

Industrial Production (IP)

- What is it?

Total value of physical goods America is producing - How it impacts truckload shipping:

The more we make, the more freight that needs to move, from raw material inputs to finished goods

Though IP has been trending downwards for several quarters, and inching closer to Y/Y negative territory, it remains stubbornly positive — in Q2, the index closed at 0.01% Y/Y, and Q3 ended at 0.1%.

While we don’t anticipate a large uptick (that would increase overall truckload volumes), as long as it remains stable, demand won’t likely get any worse either.

Imports (Goods Only)

- What is it?

Total value of physical goods America is buying from other countries - How it impacts truckload shipping:

The more we buy from other countries, the more freight that needs to move, from raw material inputs to finished goods

With chaos in international shipping markets over the past three years, this indicator has been particularly volatile.

After hitting a high of 31.9% in 2021, imports (of goods, excluding services) were down to -4.1% Y/Y at the end of Q2 2023, but moved slightly upward to -0.9% in Q3.

Though Y/Y imports dropped again, the rate of decline levelled off significantly. Similar to Industrial Production, as long as goods shipping remains relatively flat and inventories high, there will not likely be a surge in imports.

Inventory-to-Sales

- What is it?

The ratio of physical goods businesses have in stock vs. how much they’re selling - How it impacts truckload shipping:

When inventory levels are high, it creates a delay in demand for truckload shipping, as businesses will work off excess inventory before producing new goods (IP) or buying more goods (imports).

During COVID-era shipping, to combat overall supply chain volatility and high demand, shippers built up their inventories.

Despite many businesses trying to shed inventory amidst falling demand and rising interest costs throughout 2023, the ratio increased for the seventh out of the past eight quarters, finishing Q2 at 1.40.

In Q3, the index is down to 1.37, and trended downward from in July (1.39), August (1.37) and September (1.36).

Three consecutive months of decline is good news for freight markets, suggesting that destocking efforts are taking hold, setting us up for potential restocking in 2024 (i.e., more truckload shipping).

In October, the index ticked back up to 1.37, so we’ll see the full effect of Q4 in early Q1.

Macroeconomic Takeaway

Despite continued headwinds, the U.S. economy is stubbornly avoiding a recession.Regardless, the truckload cycle will continue its course.

The last time the cycle went inflationary (2020 – 2021), incremental freight demand drove rate growth. For the upcoming inflationary leg, the macroeconomic outlook doesn’t support a huge spike in demand.

Instead, supply-side constraints (carrier attrition) will likely be the driving force.

Truckload Market Trends to Watch in Q4

We have climbed out of the trough of the truckload market cycle and are heading back towards Y/Y inflation.

Exactly when we get there depends on a few different factors.

Let’s unpack a few of the key trends impacting the market before we dive into the updated Q4 forecast.

1. Freight volumes are lagging.

Though we may not be in an economic recession, we are in a freight recession, at least in terms of truckload shipping volumes.

The combination of 4th of July, Labor Day, back-to-school and pre-peak season shipping failed to cause a material uptick in truckload volumes throughout Q3. Both the Cass Shipment Index and ATA Truck Tonnage Index are showing substantial Y/Y decreases.

If we get a strong retail-driven peak season in Q4, we’ll get a faster bounce back to inflation, as demand would spike relative to current supply. However, given the persistently high inventories (see above), that is unlikely.

The continued move upward in the truckload market cycle is likely going to be supply-driven.

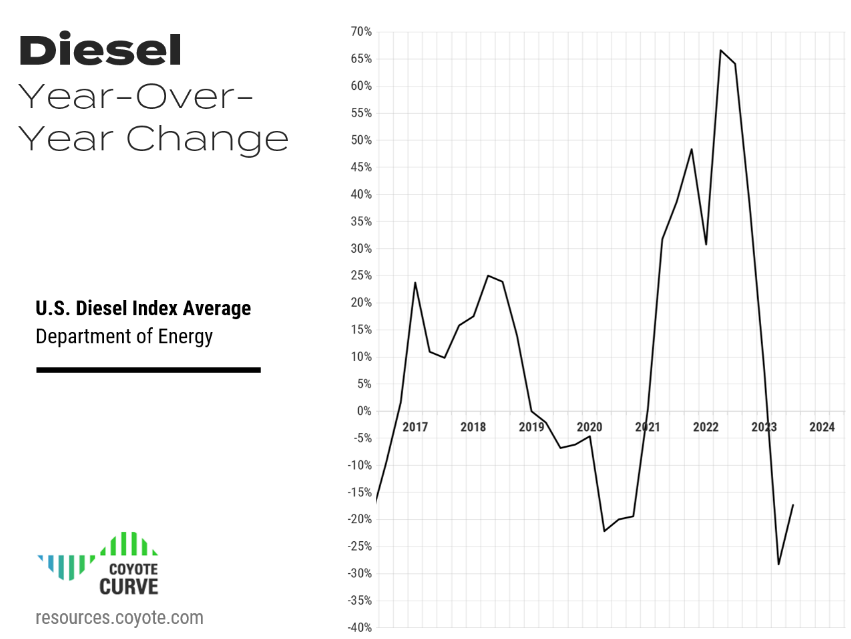

2. Fuel prices are volatile (again).

After historically high diesel rates in 2022, most of 2023 saw a significant drop.

In Q2, diesel was down -28.3% Y/Y, and in Q3, fuel was again down -17.3%.

But this is misleading to what carriers actually experienced.

June 2023 averaged $3.80 / gallon — the lowest since January 2022 — but still higher than pre-pandemic rates (full year 2019 average was $3.06).

July was stable at $3.88, but then diesel shot up to $4.37 in August and $4.56 in September.

That’s an 18% increase in fuel over the course of Q3, but all-in spot rates didn’t move anywhere near as much.

Why does that matter?

Diesel fuel, which represents around 30% of a carrier’s overall cost, can have a huge impact on a trucking company’s profitability if it rises or falls faster than freight rates.

Many carriers were able to absorb historically high fuel costs in 2022 due to historically high rates. That is no longer the case.

If fuel remains (or gets more) expensive, we’ll see a faster rise to inflation as carriers can no longer absorb the increase.

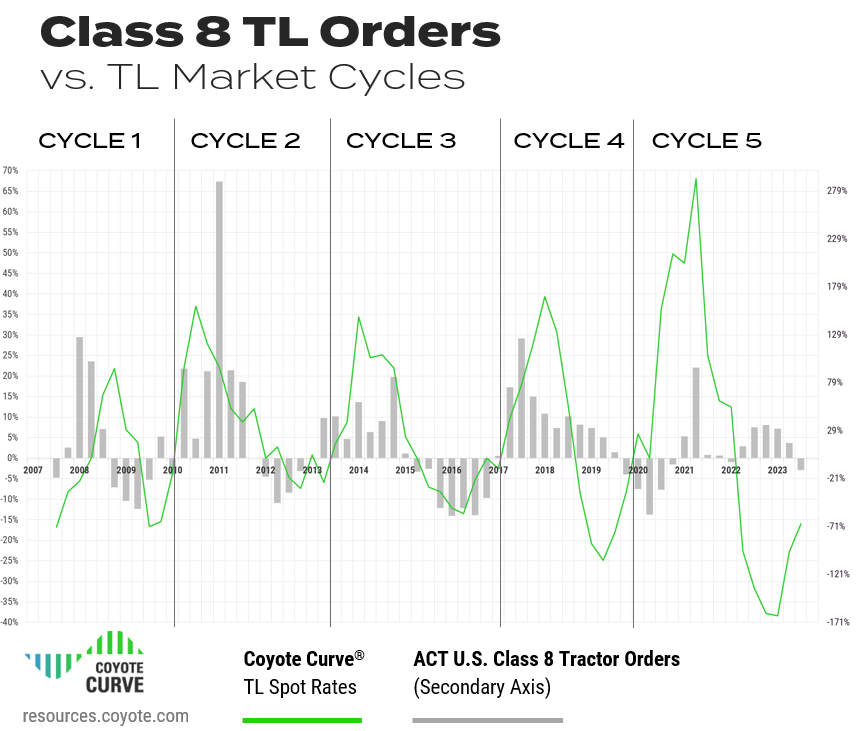

3. Carriers are buying less trucks.

In Q2, Class 8 tractor orders (as tracked by ACT Research) were up 16% on a Y/Y basis, and even up 11% sequentially (Q1 vs. Q2) — both of which were atypical for this point in the cycle.

Spot rates have been dropping for over a year, which historically leads to a decline in orders.

In Q3, we finally saw this register in orders, and the index flipped Y/Y deflationary.

This is another indicator showing the financial strain on the supply base — carriers have caught up to COVID-era backlogs, and the need for incremental capacity, or the ability to turn over old equipment is lessening.

4. Spot and contract rates will (likely) converge.

Most shippers used their 2023 transportation RFP as an opportunity to bring their contract rates back towards pre-pandemic levels.

Carriers that had been running freight on contract (or primary) rates were netting a significant premium to the spot market.

But the spot market went so low that even 2023 reset contract rates were still running at a premium.

In Q4, it’s possible that will change, as the spot market starts to rebound faster than the contract market, but for the time being, contract is still generally running at a premium.

When spot rates become more lucrative than the contract market, both in Y/Y and absolute terms, in 2024, it will create tension across routing guides as carriers look to move more drivers into the spot market.

At this point, we’ll start to see the shift from a shipper’s market back to a carrier’s market.

5. Carrier employment is waning.

Throughout most of 2023, driver employment has been curiously strong, despite weaker freight volumes. What was likely driving that?

Transitioning From Owner-Operator to Fleet Driver

When spot rates were hitting all-time highs in 2021 and 2022, many drivers opted to become owner-operators or drive for smaller fleets heavily exposed to spot market freight (as it paid more).

Now that the tables have turned, many smaller carriers without access capital or the currently more lucrative contract freight market are having cash flow concerns.

Many drivers shifted over to larger fleets for more stable, consistent freight, which held up the driver employment figures.

A Sustained Trend Downward

In Q3, we’re finally starting to see some attrition in the driver base.

After an increase in May, overall driver employment dropped in June, July and August, with August being the biggest drop since April of 2020. Though a lot of the August decline was driven by the closure of Yellow, the sustained trend shows that employment is waning.

Furthermore, this data set only includes W2 jobs (i.e., company drivers), meaning owner-operators don’t show up in employment statistics.

Given that owner-operators have little-to-no access to contract rates, we can assume their attrition rate is even higher.

Truckload Trends Takeaway

The market is heading back toward Y/Y inflation, but the speed and severity of the upward climb will depend on a variety of factors.

Over the next quarter, any combination of the following would contribute to a faster inflationary move:

- A continued spike in diesel prices

- Stronger truckload volumes for peak season

- Spot rates increasing faster than contract rates

- Continued increase in authority revocations

- A decrease in driver employment

Q4 2023 Truckload Market Forecast

We’ve covered the macroeconomic environment, and key trends — but where does it leave us going forward?

Let’s look at the latest forecast.

Download all the forecast charts in slide format for your next presentation

We predict the Coyote Curve will continue it’s move to the upside and get close to equilibrium.

We may even see December get to inflationary, but the quarter average won’t likely flip until Q1 2024.

Though a massive surge in truckload demand is not likely, there has been enough sustained pressure on the supply side over the last several quarters to constrict amount of available capacity and push rates higher.

If fuel prices remain high (or get higher), it will increase the speed at which we move back to inflation.

As the spot rates trend higher than contract rates over the next few quarters, it will drive volatility as cash-strapped carriers look to increase profitability after a difficult year.

All that said, while the index will certainly flip inflationary in 2024, we don’t anticipate the sort of extreme conditions experienced in the last inflationary market in 2020 and 2021. For guidance, a look back to 2017 would be a better comparison.

Forecast Takeaway

We have bounced off of the bottom and on our way back to an inflationary spot market, which we will likely hit in Q1.Contract rates, though trending upwards, will likely remain in Y/Y deflationary for several more quarters.

We don’t anticipate a dramatically different operating environment in Q4, but the market should start to incrementally tighten, setting up the next inflationary leg in 2024.

What Can You Do?

There is no silver bullet or special trick, it comes down to fundamentals.

Use the (relative) lull in shipping environment to maximize planning and communication with your core freight providers.

Now more than ever, be prudent about where you’re cutting rates and trimming capacity — we believe 2024 will look different than the past several quarters.

Short-term gains today could cost you in the spot market tomorrow.

Want to Know How Your Peers Are Working With Providers?

You can get insights from 500 shippers with our latest research study on supply chain outsourcing.

Read The Outsourcing Study Now

Continued Learning: Truckload Market 101

These three helpful resources will help you learn about truckload market fundamentals and how we build our proprietary index.

If you’re new to the Coyote Curve, take a few minutes to familiarize yourself with this foundational content:

Part I: Supply & Demand 101: Basics of Truckload Market Economics

Part II: Understanding the U.S. Truckload Market

Part III: Explaining the Coyote Curve

*We use the Cass Truckload Linehaul index as a proxy for contract rate performance.