Supply & Demand 101 for the Truckload Market: Learn Supply Chain Economics Basics

You don’t need a degree in economics to be successful supply chain professional.

But having a basic understanding of the fundamentals will help you stay ahead of market trends and set a better strategy.

Let’s go back to econ class for a quick recap on supply and demand and dive into a few essential freight market indicators.

You’ll be recapping freight market trends like an economist in no time.

In this article, you will learn:

Rather Watch?

Watch a truckload market expert break down supply & demand in this on-demand webinar from the 2020 Digital Summit.

It may be a few years old, but these fundamentals never go out of style.

What Are Supply & Demand? The Basic Principles

Supply and demand are basic economic principles that examine the relationship between the amount of goods or services available and the number of people who want to buy those goods or services.

While typically referenced together, supply and demand are two separate economic “laws” that govern market trends.

- The Law of Supply says at higher prices, sellers will supply more of a product or service.

- The Law of Demand says at higher prices, consumers will demand less of a product or service.

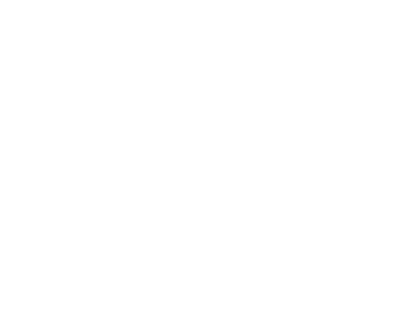

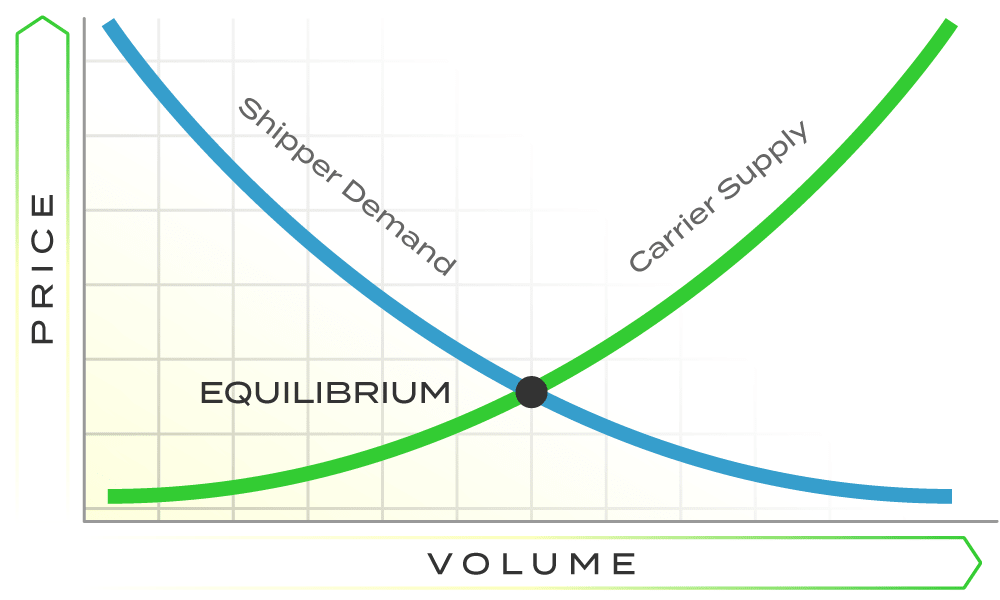

How Do You Read a Supply Curve?

The supply curve shows the relationship between price and quantity supplied. It is indicated by an upward slope on the graph (aka Supply Curve).

One of two things can happen on the supply curve:

- Supply increases.

When the price of a product increases, sellers manufacture more of that product to increase their profits. In the case of the truckload market, as rates rise, more carrier capacity enters the market as existing carriers build up their fleet and new carriers seek to enter. - Supply decreases.

As prices fall, sellers manufacture fewer goods because production is no longer as profitable. In the case of the truckload market, when rates fall, carrier capacity leaves the market as margins shrink.

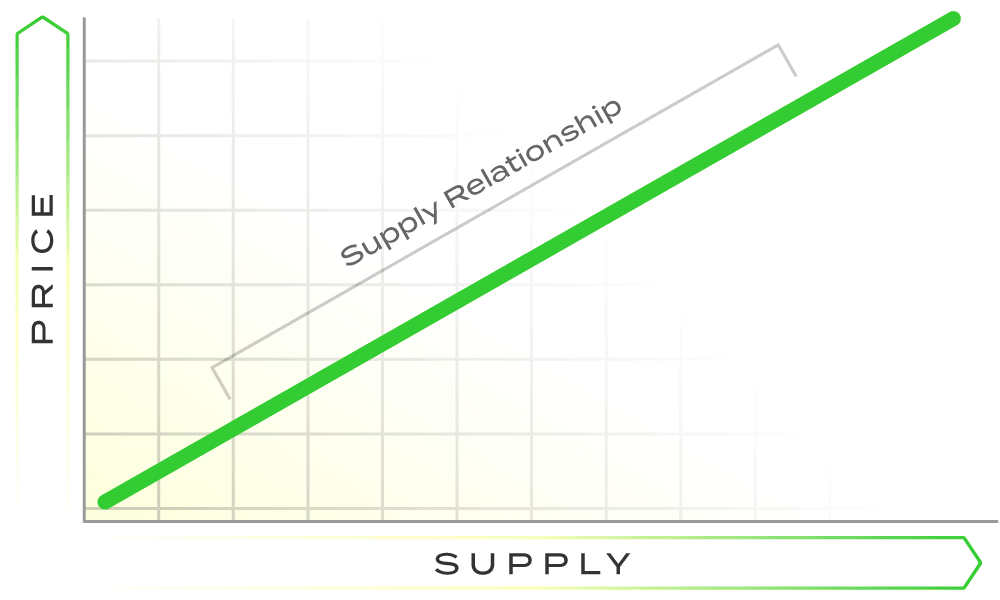

How Do You Read a Demand Curve?

The demand curve shows the relationship between price and quantity demanded and is indicated by a downward slope on the graph.

Though in the truckload market, a shipper’s demand for truckload capacity is driven more by underlying business performance than truckload price, it will impact decisions on when, where and how they ship (e.g. whether they’ll opt to convert truckload freight to intermodal).

One of two things can happen on the demand curve:

- Demand increases.

When the price of a product decreases, more customers will want to buy the product because it is cheaper. - Demand decreases.

When the price of a product increases, fewer customers will want to buy the product because it is more expensive.

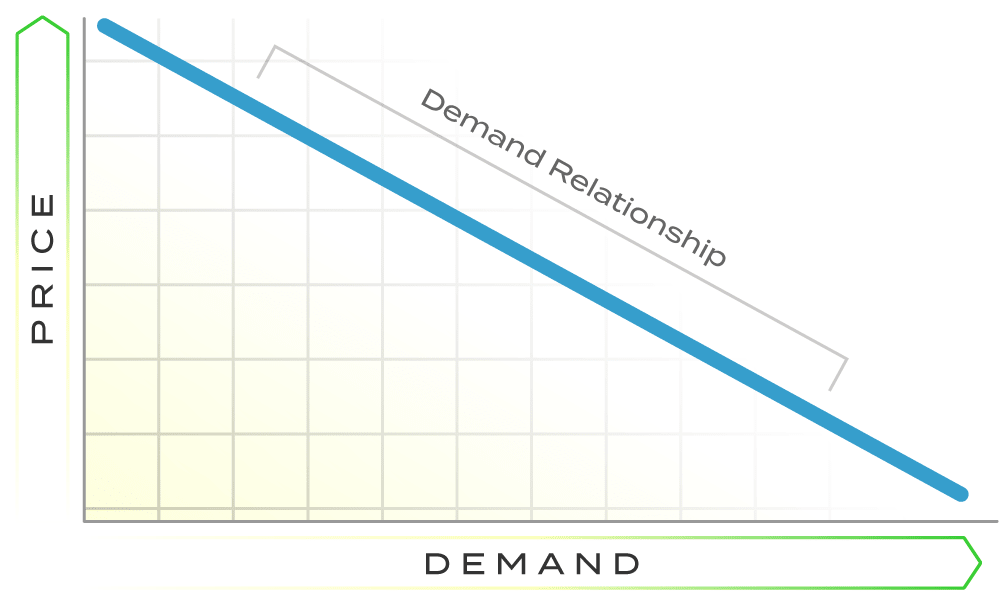

Market Equilibrium

When supply and demand are equal, the market is in a state of equilibrium. This means that the quantity of goods (or services) that sellers are supplying is in balance with the quantity that buyers are demanding.

How Do Supply & Demand Function in the Truckload Market?

Now that you understand the basics of supply and demand, let’s take a closer look at how these economic principles function for your supply chain.

Supply refers to the total amount of available carrier capacity (trucks and drivers) and demand refers to the total amount of truckload volume (loads) from shippers.

In the truckload market:

Supply = carrier capacity (trucks & drivers)

Demand = truckload volume (shipments that need to move)

Here’s how to look at a supply and demand curve applied to truckload market dynamics.

If either line moves to the left (a decrease) or right (an increase), you can see how the equilibrium price point (i.e. current spot rates) moves to meet the trend.

Let’s look at what is actually happening in the truckload market when supply or demand shift.

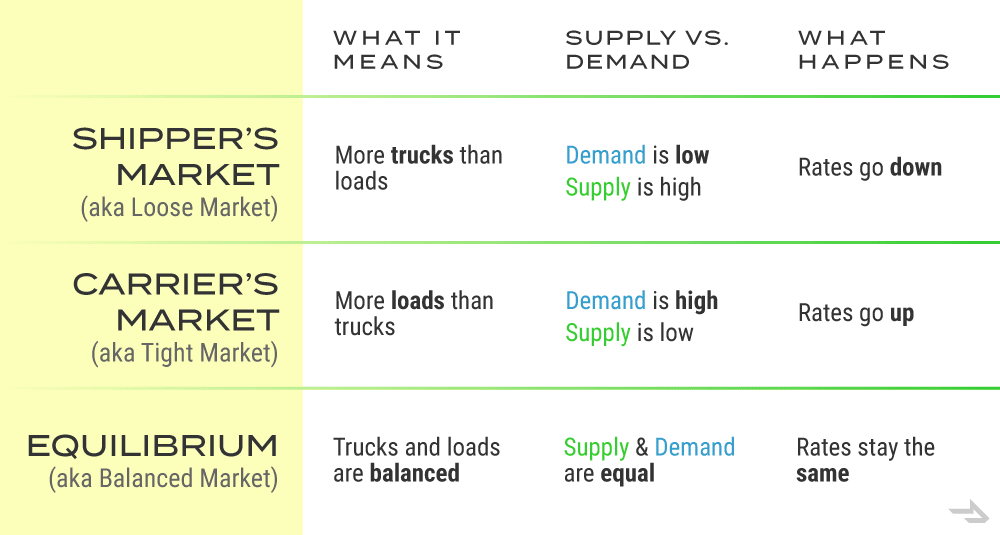

- If supply exceeds demand:

When there are more trucks/drivers than available shipments, rates go down. Because carrier capacity is high and truckload volume is low, this is known as a “loose” market — or shipper’s market, since rates favor shippers. - If demand exceeds supply:

When there are more available shipments than trucks/drivers, rates go up. Because truckload volume is high and carrier capacity is low, this is known as a “tight” market — or carrier’s market, since rates favor carriers. - If supply and demand are equal:

When the amount of shipments and available trucks/drivers are balanced, the supply and demand curves intersect. This is known as market equilibrium.

Here’s a simple chart that show what’s happening in a shipper’s market or carrier’s market:

What Economic Indicators Drive the Truckload Market?

Supply chain experts rely on a variety of data points to track truckload market activity and create forecasts.

At Coyote, we look at several different economic indicators to keep tabs on the market and influence forecasts. You will frequently come across these metrics when studying supply chain economics.

We’ll give a brief overview of what each measures so you can start analyzing the market like a pro.

Supply Indicators: DOE Diesel Index, Class 8 Truck Orders

Demand Indicators: Consumption, Industrial Production, Inventory-to-Sales Ratio, ATA Truckload Tonnage, Coyote Curve®, Cass Truckload Linehaul Index®

Supply Indicators in the Truckload Market

- Measures: Average price for a gallon of diesel fuel in the U.S.

- Where you can find it: U.S. Energy Information Administration

The U.S. truckload market is large and fragmented, and there is no accurate database that measures the exact amount of carrier capacity at any given time, so we have to get creative to measure supply.

Why is the price of diesel (aka fuel) so important? Fuel is a huge part of every trucking company’s business. It accounts for ~30% of carrier’s overall operating expenses, and this is true for owner-operators and national fleets alike.

Fuel prices tend to be much more volatile than other operating expenses (e.g. driver wages) and can fluctuate dramatically over the course of a year. This volatility can have a huge impact on carriers’ profitability.

When diesel prices shoot up faster than spot rates, carriers cannot recoup all their fuel costs, and it squeezes into their profits. If, on the other hand, fuel prices fall faster than spot rates, carriers are more profitable.

Takeaway: fuel (diesel) prices are volatile, and when they rise faster than spot truckload rates, it cuts into carriers’ profitability and can ultimately drive capacity out of the market.

- Measures: How many new trucks North American carriers are ordering

- Where you can find it: ACT Research

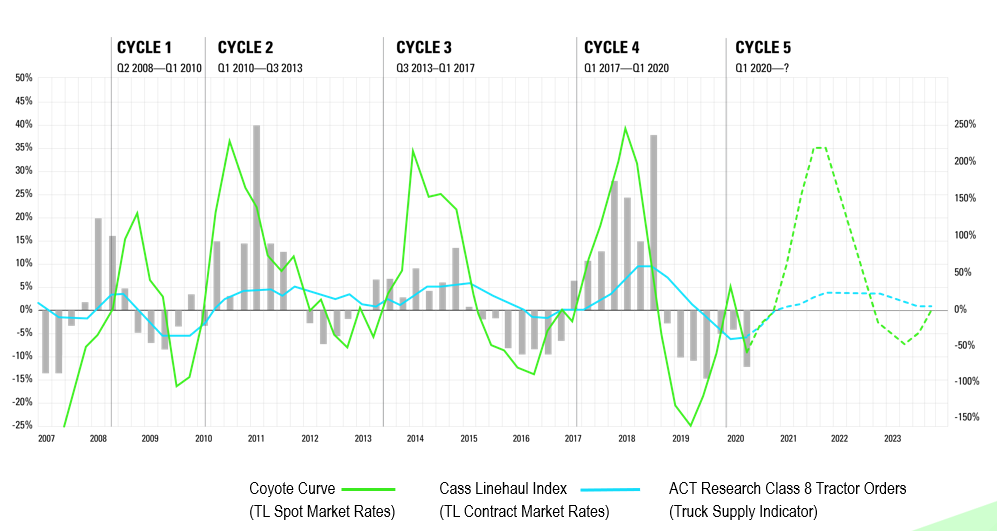

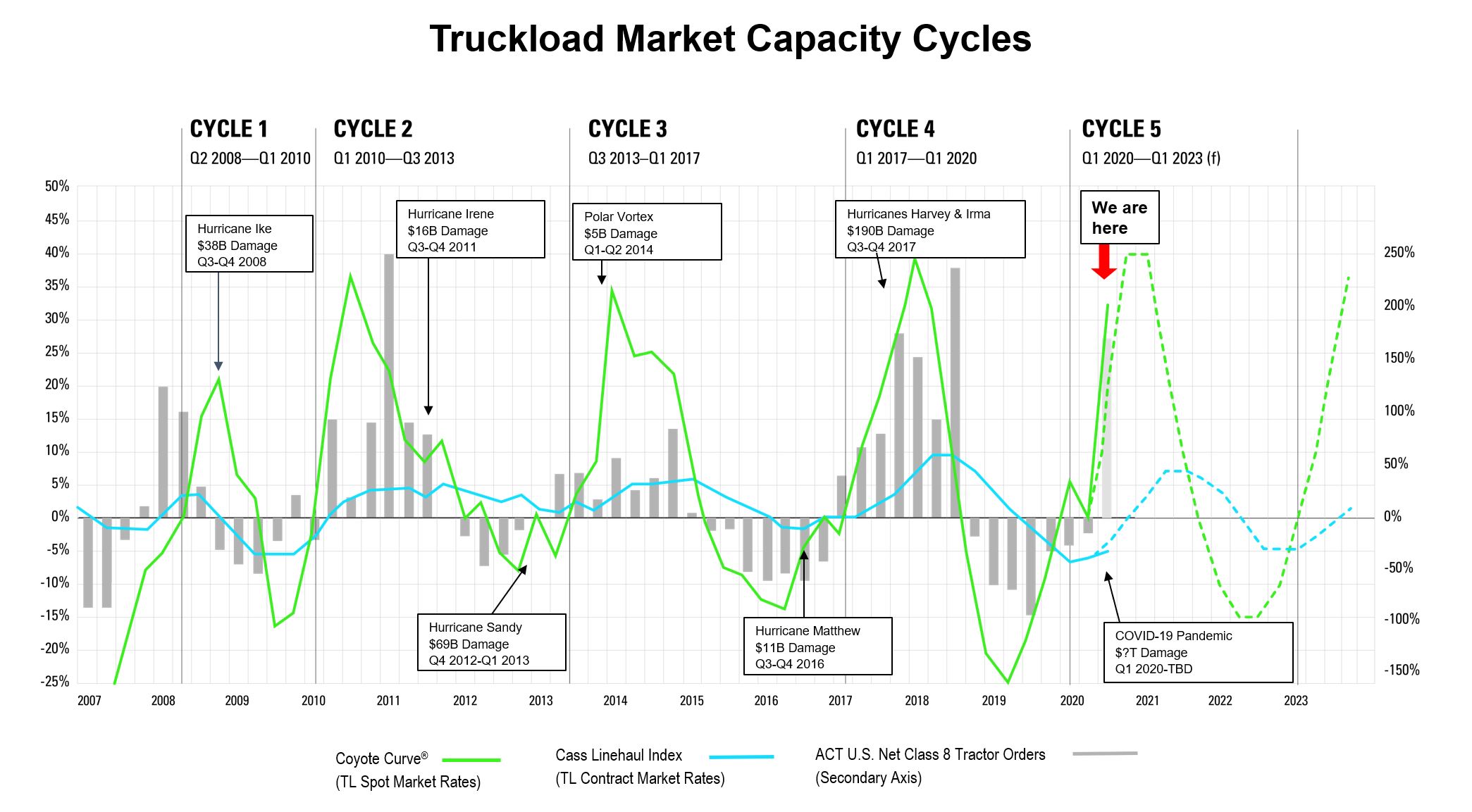

There is a strong correlation between Class 8 truck orders and where we are in the market capacity cycle.

As truckload rates increase, carriers will reinvest profits back into their businesses, buying new trucks to add capacity and/or replace old ones.

Often times, Class 8 truck orders will continue to rise long after spot rates have started to fall. However, there is a several-month delay between when a carrier places an order and when a truck enters their fleet with a driver.

Eventually, the new capacity will flood into the market when rates (and demand) are past their peak, contributing to excess supply and driving rates down lower.

You can see the relationship between the green line (year-over-year change in spot rates as measured by our Coyote Curve index) and the gray bars (year-over-year change in Class 8 truck orders).

Takeaway: carriers will often make long-term capacity decisions based on short-term rate conditions. When rates are high, they tend to overshoot, adding excess capacity that will contribute to a deflationary market.

Demand Indicators in the Truckload Market

- Measures: How much “stuff” consumers are buying

- Where you can find it: U.S. Bureau of Economic Analysis (BEA)

Consumption, or consumer spending, is the monetary value of goods and services purchased by U.S. consumers.

When consumption increases, it means we’re buying more “stuff.” The more we buy, the more shippers will have to produce (industrial production), and the more shippers produce, the more freight will need to move (truckload volume).

The opposite is true when consumption declines.

Takeaway: Consumer spending drives production, and production drives truckload volume. When consumption is high, there will be more freight volume. When it’s low, there will be less.

- Measures: Production levels in the U.S. across manufacturing, mining, electric and gas industries

- Where you can find it: Federal Reserve Board

National production (how much “stuff” we’re making as a country) is a key influencer of freight volume. This index has a direct impact on how much freight is moving across the country.

Takeaway: When IP is going up, expect shipment volume to go up. When IP goes down, it will likely mean less freight will move (unless we import enough to compensate for the decline).

- Measures: Warehouse inventory compared to sales

- Where you can find it: U.S. Census Bureau

The inventory-to-sales ratio measures the number of months of inventory shippers have on hand in their warehouses compared to their monthly sales.

(Inventory Value $) ÷ (Sales Value $) = Inventory-to-Sales Ratio

When consumption is high (people are buying lots of stuff), inventories will usually shrink as products quickly move out of warehouses to meet consumer demand. To replenish the inventory, shippers will produce more, driving up industrial production.

When consumption is low (people buy less stuff), or if there is uncertainty in the supply chain (e.g. leading up to tariff implementation), companies will stockpile inventory, either as a strategic measure or because people aren’t buying it.

Takeaway: a high inventory-to-sales ratio will act as a brake on production. When consumer demand picks up, companies will work down their inventory first before producing more.

- Measures: total volume of truckload shipments in the U.S.

- Where you can find it: American Trucking Associations

American Trucking Associations (ATA) is the largest national trade association for the trucking industry. Every month, they publish a tonnage index based on data from their national membership.

This index gives a snapshot of current truckload shipment volume (i.e. how much “stuff” is moving throughout the country). We use this as an approximation for overall shipper demand for carrier capacity.

Takeaway: when truckload volume increases relative to carrier supply, rates increase as shippers compete for capacity. When truckload volume decreases relative to carrier supply, rates fall as carriers compete for freight.

- Measures: year-over-year change in spot rate activity

- Where you can find it: Coyote’s Quarterly Market Update & Forecast

Every quarter, we publish a proprietary predictive index, the Coyote Curve, which measures transactional freight market trends from over 10,000 daily shipments, and is guided by over a decade of proprietary data.

Takeaway: spot truckload rates give a clear picture of the current carrier supply and shipper demand dynamic in a large, fragmented market.

Related: learn how we build the Coyote Curve

- Measures: Year-over-year change in contract rate activity

- Where you can find it: Cass Information Systems

In an effort to get more predictable pricing, higher-volume shippers take their forecasted shipping needs out to their carrier network for an annual bid.

In exchange for guaranteed freight volume, carriers agree on a set rate for their capacity, also known as a contract rate or a primary rate.

The Cass Index is mostly driven by freight payable information from larger shippers, which means their index is mostly composed of freight under contract rates.

Takeaway: contract rates are heavily influenced by recent spot market activity, usually trail behind spot market trends by three to six months and are much less volatile.

Take Your Supply Chain Economics Knowledge to the Next Level

Now that you have a thorough understanding of the basic principles of supply and demand and the economic indicators driving the truckload market, you’re ready for more advanced insights.

Keep learning about the three cycles that control the U.S. truckload market, then read our most recent quarterly forecast to get up to date on current market trends.