Stay Fresh: A Guide to Produce Season Shipping in the Truckload Market

Every year, as the winter fades and temperatures rise, that means one thing in the North American truckload market: produce season.

You don’t have to ship produce (or any kind of food & beverage freight) to be affected by produce season.

As drivers flood into produce-shipping regions to take advantage of short-term rate spikes, it can have a ripple effect on capacity across the market.

In this post, we’ll tell you everything you need to know to track the annual progression of produce season.

What is Produce Season for Supply Chains?

Produce season is just one example of a seasonal demand cycle (aka seasonality), one of the three main cycles that drive the U.S. truckload market:

- Annual procurement cycle (yearly freight bids / RFPs)

- Seasonal demand cycle

- Market capacity cycle

It is a short-term, expected and planned-for surge in shipping volume, beginning every spring as the temperature rises and fruits and vegetables are ready for harvest.

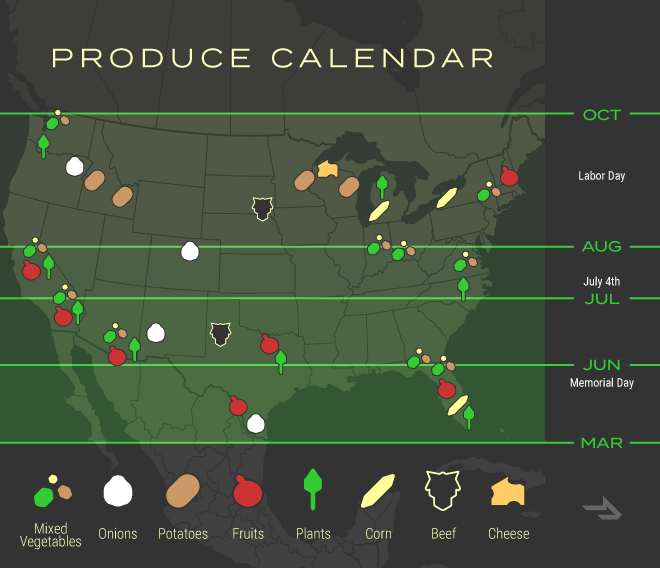

Produce season starts in the southern U.S. and moves north throughout the summer.

This seasonal shipping spike creates truckload freight supply dislocations throughout the country, and spot rates in and out of regions become volatile.

To put it plainly: produce season is a simple story of truckload market supply and demand.

How Produce Season Impacts the Truckload Market in 6 Steps

Let’s walk through the progression from crop harvest through post-season rate drop.

- Producers Harvest Crops

Farmers harvest crops out of the ground or off of trees and need to get them to market while they’re still fresh. - Produce Shippers Secure Capacity

Produce shippers with these extremely time-sensitive produce shipments are prepared to pay a market premium to secure dry van and reefer capacity. - Shipping Demand Spikes Across Produce Region

Regional carriers that work with non-produce shippers throughout most of the year will transition some or all of their fleet to take advantage of produce shipments. This creates a short-term capacity need for shippers in high-produce shipping regions (like southern Florida), whether or not they ship produce. - Rates Rise in Response to Elevated Demand

As shipper demand shoots up, spot market rates shift to entice more supply to enter the regional market to handle the freight. Spot rates inbound to produce regions begin to drop, as carriers from other regions want to strategically position their drivers, knowing they will get a profitable outbound load. - Ripple Effect Across the National Market

The ripple effect across the nation’s spot market, created as capacity leaves other areas of the U.S. and floods into Florida, Georgia, Texas, etc. can be slight or severe, depending on the state of themarket capacity cycle. - The Market Flips After Produce Season

Once produce shipping slows down out of a region, inbound spot rates will shoot up and outbound spot rates will decline.

Tracking Produce Freight Shipping Patterns Across U.S. Regions

Coming off the busy shipping months during the holiday season, consumer spending typically subsides in the early months of Q1.

In turn, freight availability typically dips across the country, and starts to pick up again in March, right when produce harvests begin.

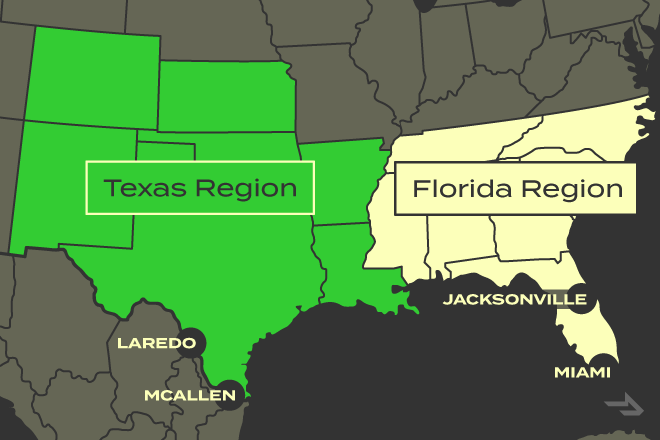

Produce Season Kicks Off in Southern Florida and Texas

The buildup to Memorial Day, as retailers stock their shelves, jumpstarts food and beverage summer shipping as well.

With produce from Mexico and Latin America hitting border cities like McAllen, Laredo, and Miami, combined with holiday demand for food and beverages, these regions become the focal points for seasonal demand shipping.

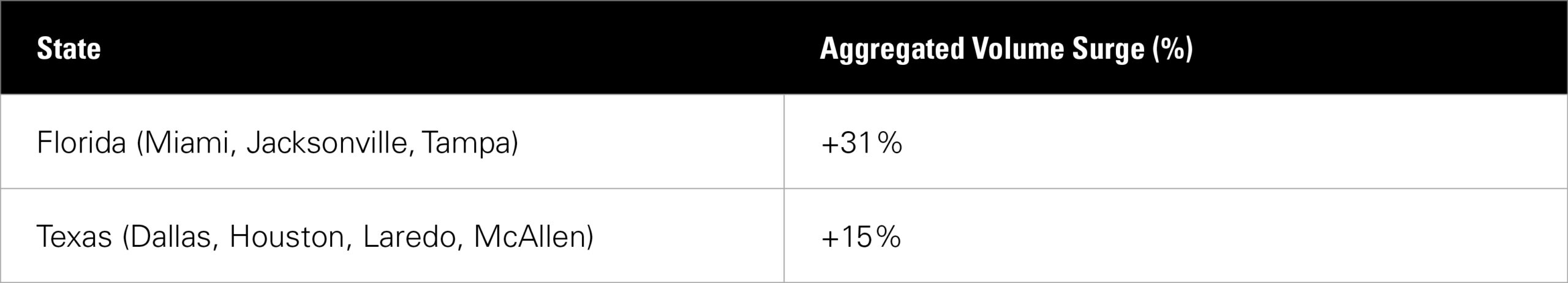

In the Texas and southeast regions, outbound spot rates can be drastically impacted by the surge in demand from produce season.

Typical Aggregated Volume Surge for Produce States: Q1 vs. Q2

As temperatures rise, so does the focal point(s) for produce shipping.

As we get into Q2, northern Florida, Georgia, northern Texas, New Mexico and southern California heat up, then the Carolinas and Northern California. Finally the Northeast, Midwest and Pacific Northwest round out the season.

Texas Region: March – April

The ramp up to produce season.

- Although year-round produce freight moves through Texas and cross-border with Mexico, the traditional produce season begins in early March. This takes up more transactional carrier capacity, both dry and refrigerated, as an influx of produce comes in from Mexico.

- Popular border cities, such as McAllen and Laredo, are typically hit hardest by the influx of volume, presenting new opportunities for carriers looking to move more freight.

- Trucks in proximity will be sent to produce shippers, which results in diminished capacity for all other shippers within 200-300 miles of those areas.

- With the season running until June, outbound Texas shipments will be highly sought after by carriers.

Florida Region: April – June

More of the same story.

- Like Texas, the Southeast becomes a produce hotbed beginning in mid-April and lasting through the 4th of July.

- Known traditionally as more of a “consumption” region, the radical increase in outbound volume due to produce serves as a coverage pain point for shippers.

- Non-produce freight coming out of FL, GA, MS, AL and the Carolinas should be planned with respect to competing produce coming out of the same areas.

- Notable shipping points will be Miami, with produce expected to move north to Jacksonville by mid-summer.

What Does This Mean for Your Business?

Whether or not you are a food and beverage shipper, produce season can impact your carrier capacity plan.

Here’s a rundown of what you need to keep in mind as temperatures start ratcheting up:

- Texas and Florida are notable hotbed states for produce.

- Coverage around produce cities such as McAllen, Laredo, Miami, and Jacksonville can pose a challenge for shippers during a few weeks in Q1 and Q2.

- Prioritize must-move freight versus shipments with some flexibility during the produce season spikes.

- Attractive pick-up and delivery times will also be a factor as carriers will look for quick turnarounds to capture more volume during the spike.

- Refrigerated equipment will be in high demand as many produce shippers require temperature control.

Plan Early for Success

The best thing you can do to mitigate produce season disruption is create a plan well in advance of Memorial Day.

Reach out to your strategic providers and make sure your forecasted needs match up with what they can provide.

During peak produce shipping season, make sure to measure your carriers’ performance and hold them accountable.

Whether or not you ship produce, create a produce capacity plan and verify it with your strategic carriers well before Memorial Day.

Find Out Where the Truckload Market Is Heading

Whatever seasonal disruptions you’re preparing your supply chain for, a sound forecast can help.

Find out the current state of the truckload market and where it’s like heading in our most recent Coyote Curve® update.