Canada vs. Mexico Cross-Border: 5 Differences Shippers Need to Know

The U.S.-Canada and U.S.-Mexico borders are two of the busiest land crossings in the world, with more than 63,000 trucks crossing those borders every day.

Whether a truck is hauling freight over the U.S.'s northern or southern border, the shipping process is fairly similar:

- All goods are subject to the same trade agreement (USMCA).

- The freight will have to clear customs and border patrol.

- Shipments require careful coordination between shippers, freight providers and customs brokers.

But these two crossings aren't exactly the same.

There are a few key differences in how things are handled at the Mexican and Canadian borders with the U.S. that every cross-border shipper should know.

5 Differences Between Canada & Mexico Cross-Border Shipping

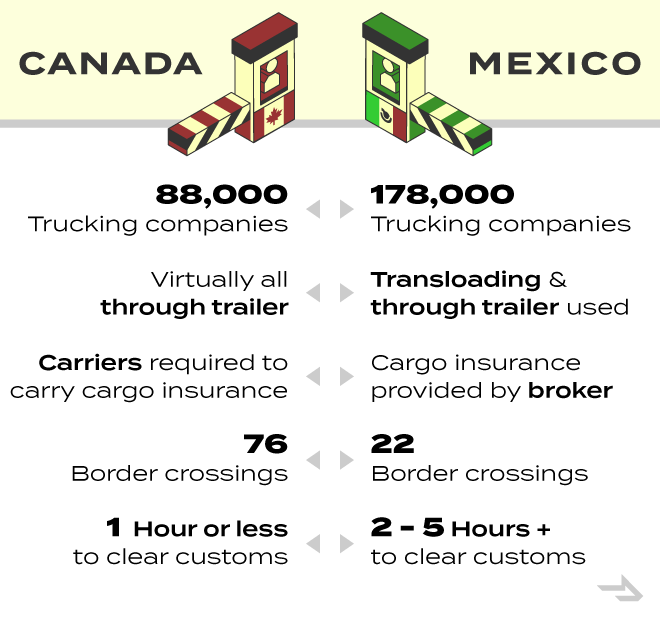

1. The Mexico carrier market is twice as fragmented as Canada’s.

Mexico sits at the crossroads of two continents, which has encouraged the development of a robust transportation and logistics industry.

But similar to the U.S. truckload market, the Mexico market is highly fragmented — there are about 178,000 for-hire carriers in Mexico, and over 80% of Mexican carriers operate fleets of one to five trucks.

By comparison, Canada has about 88,000 trucking companies.

Though it's still fragmented, the Canadian truckload market is more manageable for U.S. shippers to navigate, especially since the language and cultural barriers are lower, and the level of technology is generally higher.

The cross-border Mexico market is especially difficult to navigate, as there are multiple drivers and often multiple carriers involved in a single border crossing.

Related: How to Choose a Cross-Border Mexico Freight Provider

2. Almost all shipments crossing the Canada-U.S. border are through-trailer.

When importing to or exporting from Mexico, transloading — where freight is transferred from one trailer to another at the border — is a common practice.

Conversely, transloading is very rare for cross-border Canada freight; most shipments are through-trailer, where freight stays on the same trailer the entire time.

Why is that?

At the Mexico-U.S. Border

To haul freight in the U.S., a Mexican driver needs a B-1 visa.

Mexican carriers with B-1 drivers used to be rare, meaning the capacity pool for transloaded shipments was much larger at the Mexico-U.S. border.

But while many carriers have recently grown their B-1 driver pool and begun dual-plating their tractors and trailers to support through-trailer service for the increasing volume of Mexico-U.S. freight, transloading still has some important cost and efficiency benefits.

B1 drivers are not permitted to idle in the U.S. — instead, they must drive promptly to their destination and return to Mexico. This means that drivers will wait with the freight on the Mexico side of the border until a delivery appointment in the U.S. can be confirmed, which can lead to holding costs and pricey paperwork updates with the customs broker.

Border crossings are always performed by a B1 driver or a Mexico-based transfer carrier. Transfer carriers specialize in the short movement of cargo from a Mexican city through customs to the nearest U.S. city on the other side of the border.

So while transloading does add some logistical complexity to a shipment, most shippers still find it to generally be the most efficient and cost-effective option.

At the Canada-U.S. Border

Though they do need special licensing, Canadian drivers do not need a B-1 visa to enter the U.S. Compared to Mexican drivers, it is easier for them to pick up and deliver cross-border freight into the U.S.

This means a vast majority of cross-border Canada shipments are not only through-trailer, but hauled by the same driver.

Typically, more drivers (and carriers) are involved in a Mexico cross-border shipment.

Canada: 1 driver

Mexico: 3 drivers

3. Most carriers do not carry cargo insurance in Mexico — but your broker can offer it.

Despite the high incidence of cargo theft, Mexican carriers are not required by law to carry cargo insurance, and the vast majority do not.

There’s little incentive for carriers to buy insurance because they are liable for a very small amount — regardless of the cargo’s value — if a shipment is stolen or damaged.

However, some freight providers (including Coyote) have the ability to mitigate this risk by adding cargo insurance in Mexico as part of a complete cross-border freight solution.

Canada-domiciled carriers, much like U.S. carriers, are required to have minimum limits of third-party liability and cargo insurance.

Related: Learn how to avoid the 5 risks of shipping in Mexico.

4. Clearing Canadian customs is a smoother process.

Customs clearance is an unavoidable part of international shipping.

Compared to Canada, the process in Mexico is more complex for a few reasons.

- Drivers are required to present physical paperwork at customs for all shipments between the U.S. and Mexico, and the freight they are hauling often is subject to a physical inspection.

- The language barrier is more significant when shipping in Mexico.

- There need to be separate customs brokers for each side of the border for Mexico freight (for Canada, only the importing side needs a broker).

- There are more drivers, and often more trucking companies, involved.

5. Crossing the Mexico-U.S. border usually takes longer.

An average Mexico-U.S. border crossing typically takes two to five hours, but can take even longer if there is significant traffic or disruptions from ongoing inspections.

At the Canada-U.S. border, it is usually less than an hour. Why is that?

We have already covered how multiple drivers (and sometimes trailers) will move a shipment over the Mexico-U.S. border, but there are a few other reasons the process takes longer there.

There are fewer crossing locations.

The Canadian border is much longer than the Mexican border, and there are 76 border-crossing points along it. There are only 22 on the southern border, and many are not equipped with the infrastructure for a commercial cargo crossing.

There is more cross-border traffic.

Of the 63,000 trucks that cross in or out of the U.S. every day, 55% of them go over the Mexico-U.S. border (and that percentage is rising as nearshoring accelerates).

There is more congestion at the busiest border crossing.

The border crossing in Laredo, Texas, is the busiest in North America. More than 5.5 million trucks crossed at that point of entry in 2022.

Comparatively, the busiest port of entry between Canada and the U.S. is Detroit, Michigan, with about 2.7 million truck crossings last year, or 25% of all truck traffic.

There have been some recent, substantial infrastructure investments in Laredo to ease congestion and handle increasing volumes moving through the crossing.

Cover Both Borders With Coyote

Shipping freight across borders can be complicated. The best way to make it easier? Working with an experienced, reliable cross-border provider.

No matter where you're shipping in North America, or what borders you're crossing, Coyote can help.

Whether you're shipping full truckload, intermodal or LTL, you can trust our expertise and coverage.