Canadian Truckload Market: 8 Things Every Cross-Border Shipper Should Know

Canada and the United States share the world’s longest land border. The two nations are friendly neighbors and major trading partners.

Everything from cars to fresh vegetables cross the border every day, and 68% of that freight moves in a truck.

As you might expect, the U.S. truckload market and Canada’s truckload market have several similarities:

- Both are large, moving a majority of their nation’s freight.

- Both are fragmented, with tens of thousands of trucking companies.

Though similar, the two are not the same.

Whether you’re shipping cross-border freight from the U.S. to Canada, from Canada to the U.S. or intra-Canada, it’s important to understand the basics of the Canadian carrier market.

8 Things Every Shipper Should Know About the Canadian Truckload Market

1. Canada puts the “long” in long-haul.

Canada’s geography has a lot to do with the differences between the two trucking markets.

Both countries are huge: the U.S. and Canada are two of the three largest countries in the world by land mass, but the latter is far less dense.

Canada is only slightly larger than the U.S. in terms of physical size, but only has about one-tenth the population.

That adds up to a lot of open road between population centers.

2. Smaller economy, smaller truckload market.

With a smaller population, comes a smaller economy — Canada’s gross domestic product (GDP) is only 8% of the U.S. GDP.

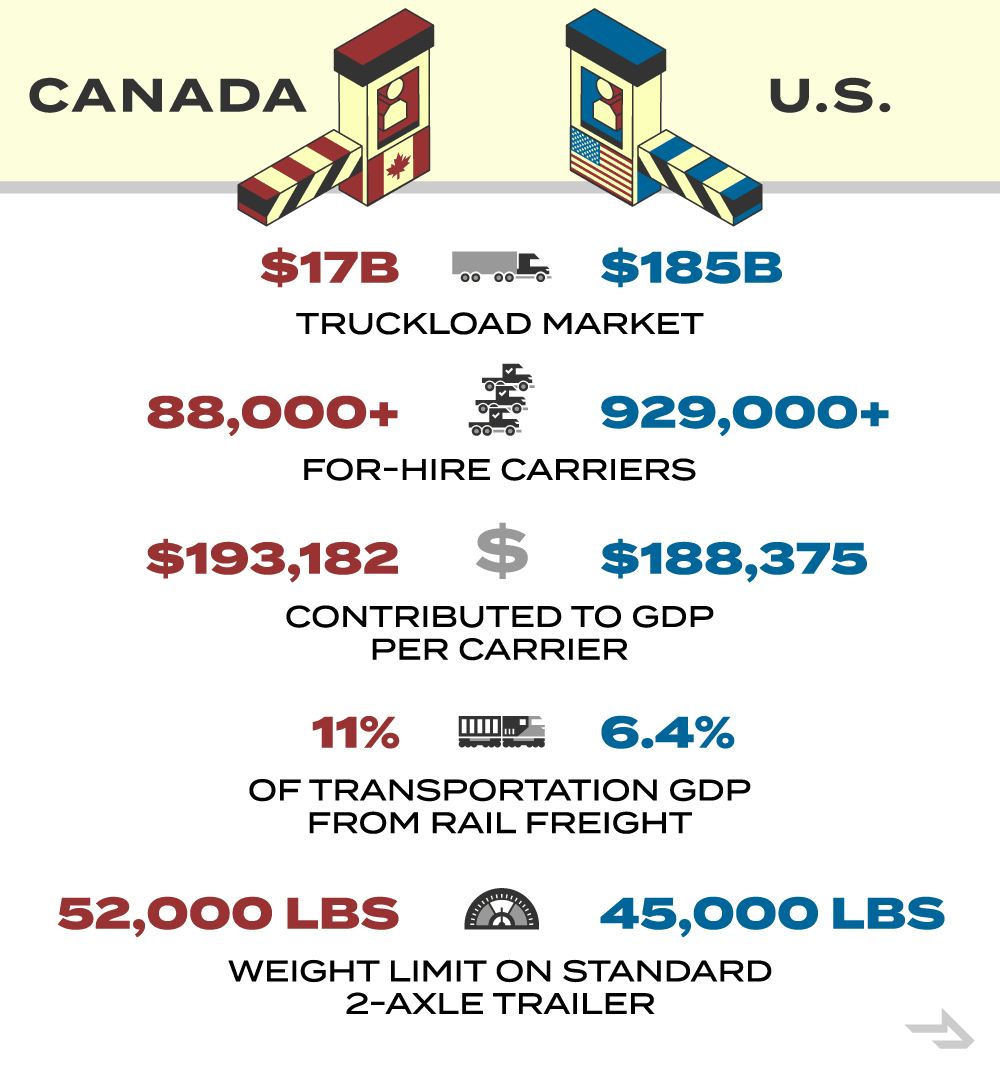

With a smaller economy, comes a smaller truckload market — Canada’s truckload market contributes $17 billion to its annual GDP, compared to $185 billion from for-hire trucking in the U.S.

How big is the trucking market in Canada compared to the U.S.?

- By contribution to GDP: 9.7% of the size

- By number of carriers: 9.4% of the size

3. Smaller market, but still highly fragmented.

Like the U.S., the Canadian for-hire carrier market has thousands of participants, with no single provider commanding a big chunk of market share. There are over 88,000 trucking companies in Canada, and 99.5% have less than 100 employees.

TFI International, the largest Canada-based for-hire carrier by revenue, is only the 11th largest in North America; of the 100 largest on the continent, only nine are based in Canada.

So how fragmented is it?

- In the U.S.: +929,000 for-hire common carriers

- In Canada: +88,000 for-hire common carriers

Let’s adjust for market size by comparing the number of carriers in each country versus the industry’s overall contribution to annual GDP.

Takeaway: though the Canadian truckload market is much smaller, it is only about 3% less fragmented than the massive and complex U.S. market in terms of the percentage of freight each carrier moves on average.

4. More pricing stability.

In the U.S. truckload market, spot pricing swings dramatically from one season to the next (often times, one week to the next). Canada tends to be far less volatile.

Why? There are several reasons, some cultural and some economic, but here’s an overview of a few of them:

- Though fragmented, the market is still much smaller.

- Much Canadian freight consists of raw materials, which tend to be less seasonal.

- Agricultural freight in Canada is also less seasonal than in the U.S. (less produce, more grain), which can be stored and shipped all year round.

- For cross-border freight, Canadian-based carriers value efficiency and consistent opportunities over chasing rates.

5. More competition from the railroads.

Rail shipping, whether bulk or intermodal, plays a bigger role in Canada’s economy because of the long distances between cities and lower population density.

With such vast expanses of land to cover, the economics of intermodal conversion become more and more attractive.

Rail transportation is a bigger part of Canada’s freight economy.

Rail also plays a bigger role in cross-border shipping.

- For Mexico-U.S. trade, 83% of freight crosses in a truck

- For Canada-U.S. trade, 68% of freight crosses in a truck, with rail and pipeline taking a bigger share.

6. The weight restrictions are different.

No matter which country you’re shipping in, drivers have to comply with weight regulations, but in Canada, carriers can haul heavier loads.

This helps to make freight hauling more efficient across longer distances.

In the U.S., the federal government sets the standard that specifies maximum weights (80,000 lbs. gross) on federal highways.

In Canada, standards are set by the provinces, but here is a general guide:

- Carriers can load up to 92,000 lbs. in freight using a B-train trailer (two trailers linked together). Note: B-trains are mostly used for open deck freight shipping, but there are van trailer applications as well.

- On a standard two-axle trailer, carriers can usually load up to 52,000 lbs. in product (compared with about 45,500 in the U.S.).

- Tri-axle trailers can load up 62,000 lbs. for intra-Canada shipments.

To avoid any cross-border shipping mistakes, you have to comply with the lowest weight limit in any province your freight will move through.

7. Relationships with carriers are very important.

No matter where you’re shipping freight in North America, two things are true:

- Transportation and logistics are a relationship-based industry.

- Cost is important.

That said, in the U.S., the balance tends to tip in favor of cost; shippers are generally more comfortable with price shopping and testing out new carriers.

In Canada, shippers are more relationship-driven, treating their carriers like partners. This is especially true in smaller markets where local carriers are an integral part of the business community.

8. Carriers work together to get freight delivered.

Because Canada is so huge, carriers tend to be specialized in a particular region and do not have operations in every market. It’s hard to be a true national carrier with so much land and so little freight density.

To solve this, many carriers work together on long-haul freight that crosses into different regions, with one carrier handling pickup and the linehaul, then dropping it off with a partner carrier for final delivery.

This is common practice, especially in the LTL carrier market.

Add Value to Your Canada Truckload Freight With a Cross-Border 3PL

Canada’s geography and fragmented truck market can make it hard to have visibility into all of your transportation options.

And because Canada is so spread out, it’s doubly important to find the right carrier for each lane — this can have a dramatic impact on cost and service.

Sourcing carriers, especially for smaller shippers with inconsistent freight, sourcing reliable capacity can be a huge challenge.

An experienced 3PL can help consolidate this fragmentation, bringing your supply chain more capacity options with far less effort and finding the trucking company that specializes in your opportunity.

Learn how Coyote can help with your cross-border Canada freight.