5 Things Shippers Need to Know about the Truck Driver Shortage

COVID-19 has (among many other things) disrupted the labor market.

Even with high unemployment, some industries, such as manufacturing and retail, are having a tough time filling jobs.

This has been especially true in the commercial trucking market, where the “driver shortage” has been a topic of conversation (and debate) for years.

- Is there a commercial driver shortage?

- How does trucking compare to other labor markets?

- What next steps can shippers and carriers take to alleviate the pressure?

We teamed up with labor market research specialists Emsi to analyze what’s really going on, and to try and answer these questions.

Together, we created an original research study to give you a clearer picture of the job market for the logistics industry — especially long-haul truck drivers — so you can better understand how it impacts your business.

You can get an in-depth look the research and actionable next steps by downloading the driver shortage researh study, but reading these key takeaways first will help you get ready for a deeper dive.

1. Truck drivers make up 30% of a huge labor market.

The transportation and warehousing labor market is huge. It's the 11th largest industry by work force size in the U.S., employing 6.4 million people.

And it’s growing, increasing 3.2% since 2019, in large part driven by growth in e-commerce shipping.

Truck drivers (specifically heavy tractor-trailer drivers) are a big part of the industry, accounting for 30% of all jobs with 1.9 million drivers. And the demand for drivers is also growing, increasing 2.1% since 2019.

Related: Learn the 6 key challenges driving the driver shortage in the full infographic.

2. It's 9x harder to hire a truck driver vs. comparable occupations.

Though the industry is growing, hiring drivers has not been getting any easier.

We analyzed job posting data and found that, since 2016, there are six job postings for every driver that gets hired (looking at all types of commercial drivers).

If we narrow the scope to just heavy tractor-trailer drivers (i.e. class 8 semi-truck drivers), it’s even more competitive, shooting up to one hire for every nine postings.

But is that good or bad? How does that stack up to other labor markets?

If we aggregate the data from all similar “blue-collar” occupations, the ratio comes all the way down to one posting for every hire.

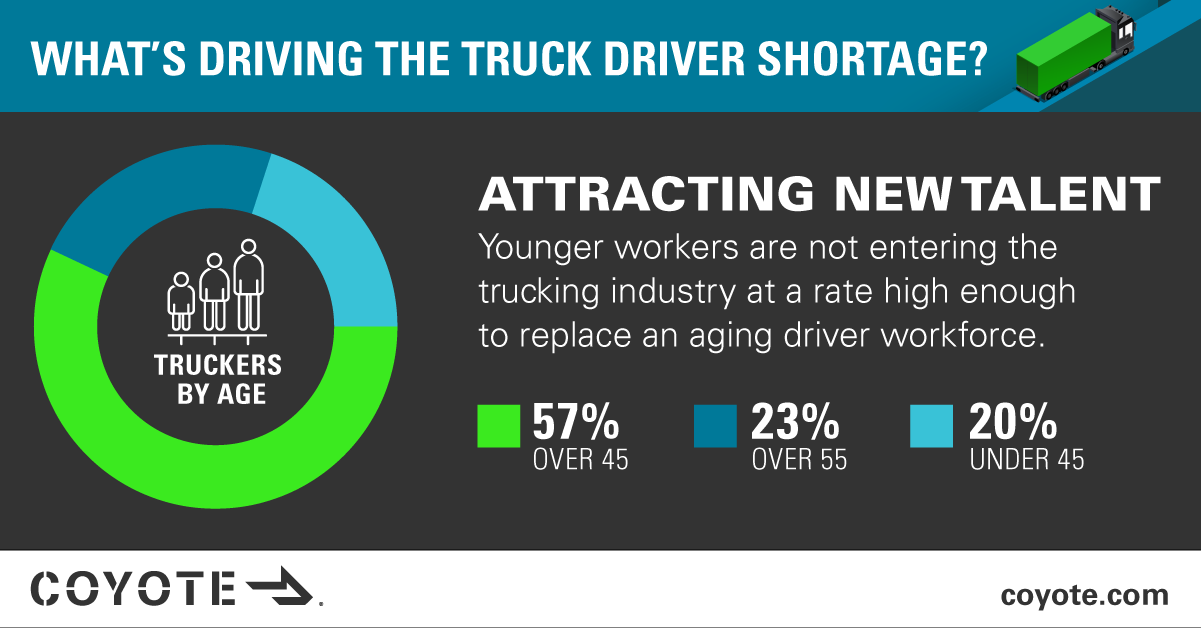

3. The workforce is aging, & recruiting young talent is challenging.

Not only is the labor market competitive now, but as a big chunk of the driver pool nears retirement, that’s only going to increase until we get more young talent to enter the market.

Nearly 57% of truckers are over 45, and 23% are over 55.

Bringing on new talent has not been easy — 28% of carriers say that recruiting new drivers is a top three business challenge.

Many millennials and younger people are entering the logistics industry; however, they are gravitating towards warehousing jobs.

Over 62% of warehouse jobs are filled by people under 45.

This almost the exact opposite of truck drivers, where a majority are on the other side of 45.

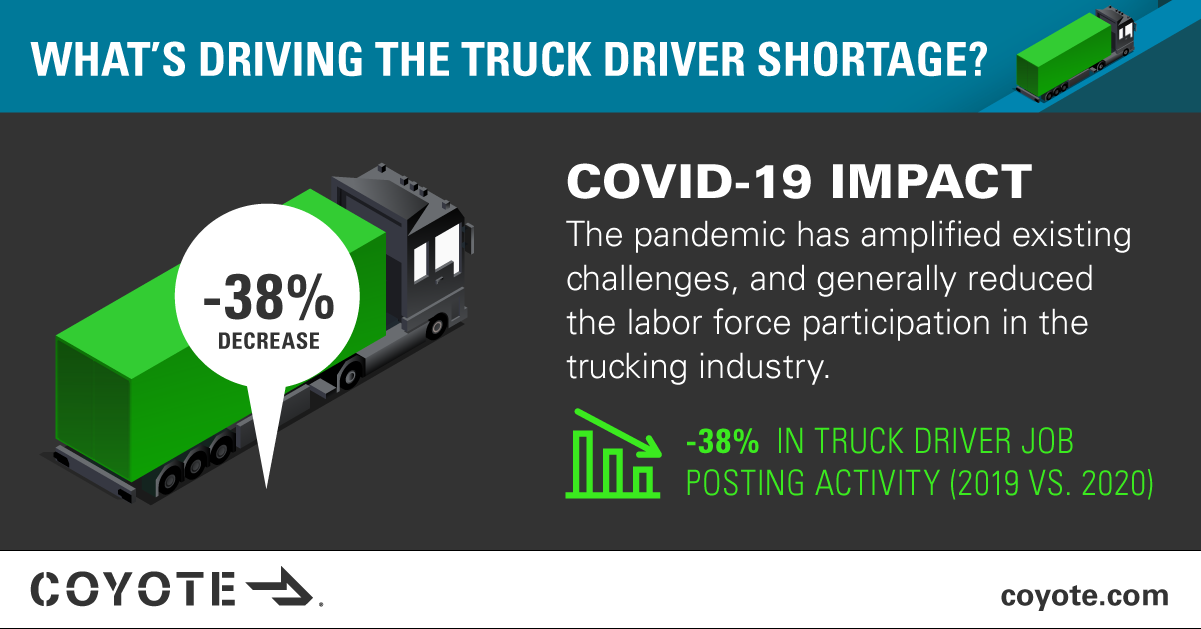

4. The COVID-19 pandemic has complicated an already tough labor market.

Labor force participation has taken a nosedive during the pandemic, meaning more people weren’t actively looking for a job.

There are several reasons for this, including:

- Frustration with employment prospects

- Safety concerns

- Expanded unemployment benefits

- Having kids at home

Whatever the specific reasons, in late 2020, Emsi observed a broader shortage of workers, especially for more entry level (sub $20 per hour) roles.

All this adds up to an even tougher time for recruiting truck drivers.

5. The driver shortage is everyone’s problem, not just carriers.

America’s trucking industry is the lifeblood of our economy, hauling more than 70% of the freight shipped in the U.S.

And shippers also employ drivers too — about 50% of U.S. trucking operations are actually private fleets.

To keep increasingly complex supply chains running, we need capacity. In short, we rely on the drivers behind the wheel to make business possible.

You don’t have to employ drivers to make a difference — every touchpoint in the supply chain can impact driver satisfaction and retention, which can bring stability to the truckload market.

Every touchpoint in the supply chain plays a part in driver satisfaction and retention.

What’s Next for Shippers?

For an in-depth look at the data about the commercial driver shortage, how it impacts the market and actionable next steps for the path forward, download the full research paper.

If you're looking for more information on how to elevate your talent acquisition strategy for drivers or other positions, Emsi's labor market data and experts can guide you through the best ways to attract and source talent.