Shipping Trends for November 2024: Latest Freight Market Cheat Sheet

Bienvenido a la hoja de referencia del mercado de transporte de mercancías.

En esta breve guía, los profesionales de la cadena de suministro (como usted) pueden obtener una rápida actualización sobre lo que está sucediendo en los mercados de carga de América del Norte este mes.

Obtenga información impulsada por expertos del mercado y datos de red patentados.

Saltar a la sección:

Descripción general | Camión | LTL (consolidada) | Intermodal

México | Canadá | Noticias Coyotes

Descripción general del mercado de carga

The peak season shipping buildup is underway.

We may be in a new ciclo de mercado de carga de camiones (according to our Curve forecast), but we’ve yet to see a huge upswing in freight market activity.

Veamos algunas tendencias antes de profundizar en tarifas y modos.

Capacity is getting a little tighter

In recent weeks, we’ve seen our network coverage indicators (i.e., tender rejection rates, carrier acceptance, bounce rates, offers per load) show signs of a tighter carrier market.

Seasonality is picking up

We’re seeing more of a Q4 seasonal push as peak season heats up, with rates from the Midwest, Northeast and Pacific Northwest all tracking higher in recent weeks. That will likely to continue into the holiday shipping season.

Despite this, the hyper-competitive market we’ve seen over the past two years has kept overall rates historically depressed, but there are some signs of a shifting market. It’s likely December 2024 will be tighter than 2023, but the real question remains what will things look like after the holidays in January and February.

The spot / contract divide

Ultimately, while spot rates may be gradually tightening, overall industry demand remains in neutral.

For now, carriers (that are able to) will accept their contract freight, even if spot loads are incrementally higher. Before a market turn can begin in earnest, spot rates need to be meaningfully higher than contract rates.

Full Truckload Trends: November 2024

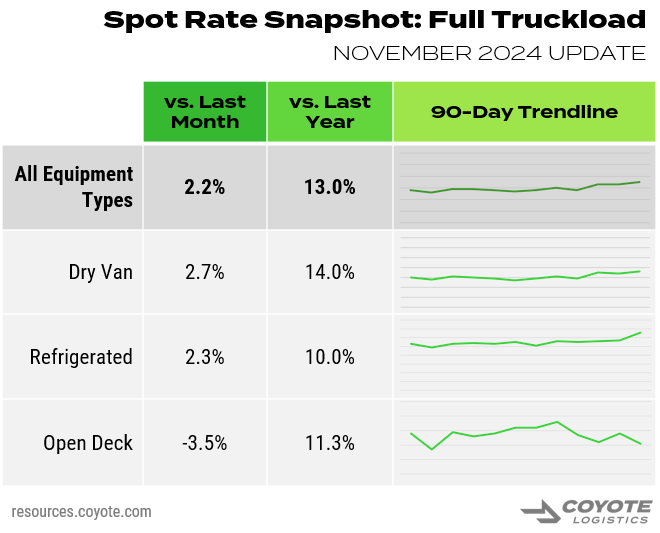

In October, we saw overall truckload rates climb 2.2% month-over-month (M/M), trending up slightly after several weeks of stagnation.

Looking at equipment types, dry van (2.7%) went up a notch, refrigerated moved up 2.3%, and open deck moved down -3.5%.

Looking at year-over-year (Y/Y) comparisons, we continued our venture into inflationary territory in total (13.0%), dry van (14.0%), reefer (10.0%), and flatbed (11.3%).

Nota sobre los datos: todas las cifras de tarifas de carga de camiones se derivan de los datos transaccionales patentados de Coyote. Con miles de envíos diarios, es uno de los mercados de carga centralizados más grandes de América del Norte.

LTL Trends: November 2024

LTL merger & acquisition activity

Knight-Swift completes Dependable Highway Express acquisition

Knight-Swift, traditionally a truckload-focused carrier, continues to build out their national LTL footprint. This started with AAA Cooper, who was primarily a southeast carrier, followed by Midwest Motor Express. Most recently, Knight-Swift completed the acquisition of Dependable Highway Express, giving them California, Arizona, and Nevada coverage.

AAA Cooper, Midwest Motor Express, and Dependable Highway Express (DHE) are now fully integrated into one operating system. In CoyoteGO, DHE lanes will now populate as AAA Cooper and will move on their SCAC (AACT).

Moran Transportation acquired RMX Freight Systems

Moran Transportation has acquired RMX Freight Systems. RMX had full coverage of Ohio and partial coverage in Michigan and West Virginia.

This blends with Moran’s existing coverage throughout Illinois, Indiana, Wisconsin, Minnesota, Missouri, North Dakota, and South Dakota. They also offer cross-border coverage to western Canada.

Results from recent LTL customer survey

Mastio conducts an annual study of LTL shippers and recently released their 2024 findings, based on interviews from 1,608 shippers.

In the overall rankings, Daylight Transport finished first, followed by Averitt, Old Dominion, Peninsula, and Dayton Freight.

The top carriers in their respective regions were Ward, Southeastern Freightlines, Dayton Freight, and Peninsula.

News from LTL carriers’ Q3 earnings

Old Dominion

- With dimensioners (tools on the dock that ascertain the actual dimensions of pallets before shipments) in most major service centers, Old Dominion measures about 75% of their network’s freight. They expect upcoming NMFC changes to provide them with a strategic advantage over competitors.

XPO

- XPO has opened 21 of the 28 terminals acquired from Yellow Corp. Eight terminals are in new markets, while 13 are relocations to better-suited spaces. The remaining seven centers will open by early 2025.

- Tonnage is expected to decrease by 8% year-over-year in October due to normal seasonal demand trends. The industry saw a boost from a cyberattack at Estes in early October 2023, adding about 1,000 shipments per day to XPO’s network.

- XPO noted that industrial customer shipments declined at twice the rate of retail customers in Q3.

TFI (Tforce)

- TForce is moving less freight by rail; however, claims increased to 0.8% in Q3 2024, and missed pickups remain relatively high at 400 per day.

- They are seeking M&A targets in 2025, focusing on 3PL and LTL, aiming for a $4B to $5B deal in the U.S. by 2026, with the primary focus being U.S. LTL.

- They plan to implement a new pricing/billing system in early 2025 to address billing challenges.

- They have the capacity for 40,000 shipments per day but currently handle 22,000.

Changes coming to NMFC classifications in 2025

The NMFTA is in the process of making changes to the NMFC classification system. Changes will not go into effect until May of next year, but it is going to impact many shippers.

NMFTA initially announced they would be changing over 5,000 NMFC item numbers to a density-based scale. The most recent update listed over 3,000 of those items as Out of Scope for the 2025-1 docket. Reviews are ongoing and the final list will be available in January.

Here’s a timeline of the changes:

- January 2025: Docket 2025-1, a list of NMFC items that are potentially going to change, will be available for review.

- March 2025: The NMFTA will hold a public meeting to discuss the changes.

- May 2025: NMFC changes will go into effect.

To stay updated, visit the 2025 NMFC Changes page on the NMFTA site.

Intermodal Trends: November 2024

North American intermodal volume is holding strong through early November, but the shift in load originations suggests that we may be past the annual volume peak off the U.S. west coast.

Weeks 43 and 44 were among the highest-volume weeks of the year — only week 37 saw more IMDL volume — but the volume gains have come primarily form the eastern railroads (CSX & NS), while the western railroads (Union Pacific and BNSF) have seen volumes decline slightly.

Los Angeles remains the tightest U.S. metro for intermodal capacity (both equipment and drivers), though a couple days of lead time has been sufficient to secure coverage.

Broadly speaking, intermodal pricing trends haven’t changed much over the past month as we enter the traditional intermodal bid season (typically November through April/May). For contractual freight, the railroads are still looking for slight Y/Y rate increases out of most metros; however, they have also acknowledged that they can’t really make moves on pricing until truckload rates make a meaningful rise.

Shippers who are able to lock in an annual contract in the coming months before the truckload market shifts will likely get better savings vs. truckload in 2025.

Relacionado: Intermodal versus carga por camión: 4 cosas que todo transportista debe saber

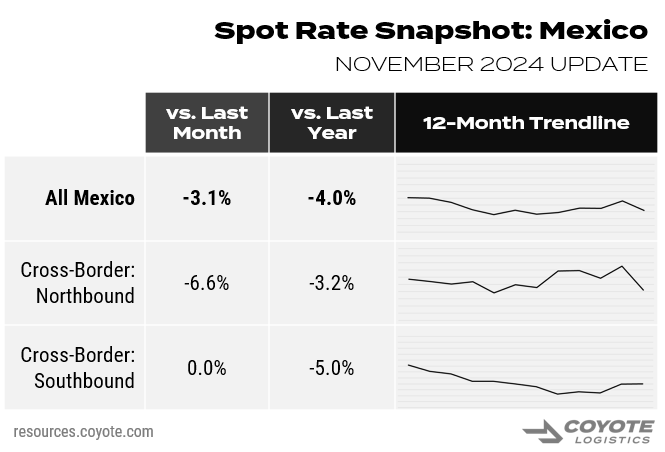

Cross-Border Mexico Trends: November 2024

After climbing up slightly in September, in October, rates dropped -3.1%, with northbound rates decreasing by -6.6% M/M, and southbound rates remaining flat.

Year-over-year, rates were slightly down across the board.

Nota sobre los datos: todas las cifras de tarifas de carga de camiones se derivan de los datos transaccionales patentados de Coyote. Con miles de envíos diarios, es uno de los mercados de carga centralizados más grandes de América del Norte.

Relacionado: Cómo enviar carga transfronteriza entre Estados Unidos y México

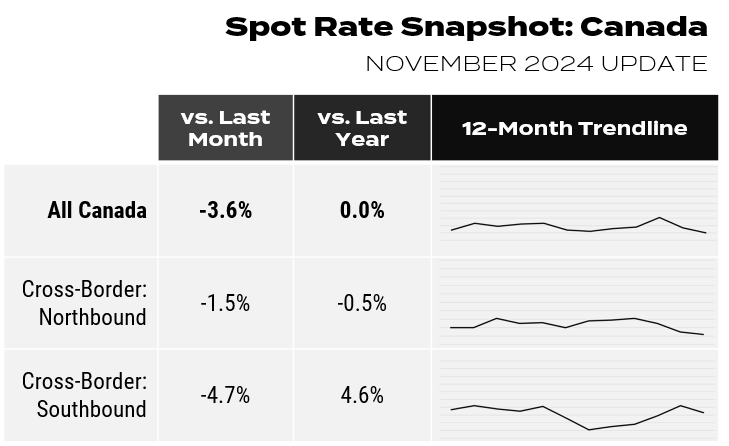

Cross-Border Canada Trends: November 2024

In October, overall rates were down -3.6%, with northbound decreasing -1.5% and southbound decreasing -4.7%.

Nota sobre los datos: todas las cifras de tarifas de carga de camiones se derivan de los datos transaccionales patentados de Coyote. Con miles de envíos diarios, es uno de los mercados de carga centralizados más grandes de América del Norte.

B.C. Port Strike

As of November 4th, a major labor dispute in British Columbia resulted in port employers locking out more than 700 foremen, affecting key trade operations. The B.C. ports handle 25% of Canada’s goods flow.

This move followed a strike notice by the foremen’s union. These disruptions could affect supply chains across the country if the situation is not resolved quickly, but sides have agreed to return to negotiations as of November 8th.

Winter is coming

When you think of Canada, cold weather is probably one of the first things that comes to mind. Protect-from-freeze season has started with shippers, so expect demand for reefer capacity to stay elevated as temperatures drop.

If you haven’t done so already, establish a plan for how you’ll keep your freight safe an secure the capacity you need.

Relacionado: Cómo enviar carga transfronteriza entre EE. UU. y Canadá

Noticias Coyotes

Coyote has been acquired by RXO. Learn more about how the combined company will bring value to shippers and carriers.

¿Quieres la hoja de trucos en formato PDF?

Complete este breve formulario para descargar un PDF de la última hoja de referencia del mercado de transporte para una referencia rápida.