As any shipper will tell you (and research shows), keeping transportation costs down is a top business challenge. This is especially true for small and mid-sized companies.

Another top-ranked challenge? Sourcing consistent, reliable carrier capacity.

Many shippers use contract pricing to help solve both challenges.

Though contract rates can bring some stability to your freight budget, getting them isn’t quite as simple as getting a spot rate. Some common questions for shippers looking for rate consistency are:

- How do you get contract rates?

- How much freight do you need?

- Do you need a technology platform to manage contract freight?

- When are spot rates better?

- How long do contract rates last?

We’ll answer these questions and more, so you can start running a more cost-effective transportation network.

What Are Contract Rates for Freight Shippers?

Contract rates — also referred to as primary rates, bid rates or dedicated rates — are a type of long-term, stable pricing for truckload freight.

They are usually set during an annual bid, aka request for proposal (RFP). When a business runs a transportation RFP, they take their forecasted shipping needs to their providers (carriers, 3PLs, etc.) and ask for committed pricing for their expected volume.

At the end of the bid process, the shipper will award lanes to specific providers based on rate, service, capacity and other considerations.

Shippers give committed load volumes, and carriers give fixed transportation rates — it’s a win-win.

Contract rates are a type of fixed, long-term truckload pricing for consistent freight volumes.

Why Do Shippers & Carriers Use Contract Rates?

The U.S. truckload market is massive and highly fragmented. There are thousands of carriers and shippers, each with their own agendas, strategies and networks.

This creates an environment where both pricing and carrier capacity are constantly shifting — predictability is hard to come by, whether you’re on the supply or demand side of the market.

Why shippers like contract rates:

- Easier budgeting & forecasting

- More reliable capacity

- Ability to build strategic carrier relationships

- More accountability from providers (KPI tracking)

Why carriers like contract rates:

- More predictable revenue

- Consistent, and more efficient, driver scheduling

- Increased driver satisfaction

Simply put: contract pricing brings both shippers & carriers some predictability in an otherwise volatile truckload market.

What’s the Difference Between Contract Rates and Spot Rates?

No shipper runs all of their freight at committed rates — instead, businesses use a strategic blend of contract and spot.

Spot rates are short-term, transactional freight pricing that reflect the real-time balance of supply and demand in the truckload market.

Shippers use spot rates for three main reasons:

- Their primary and backup carriers cannot cover a shipment.

- There is an urgent, unexpected shipment.

- There is not enough freight density or consistency to justify contract pricing for a given lane.

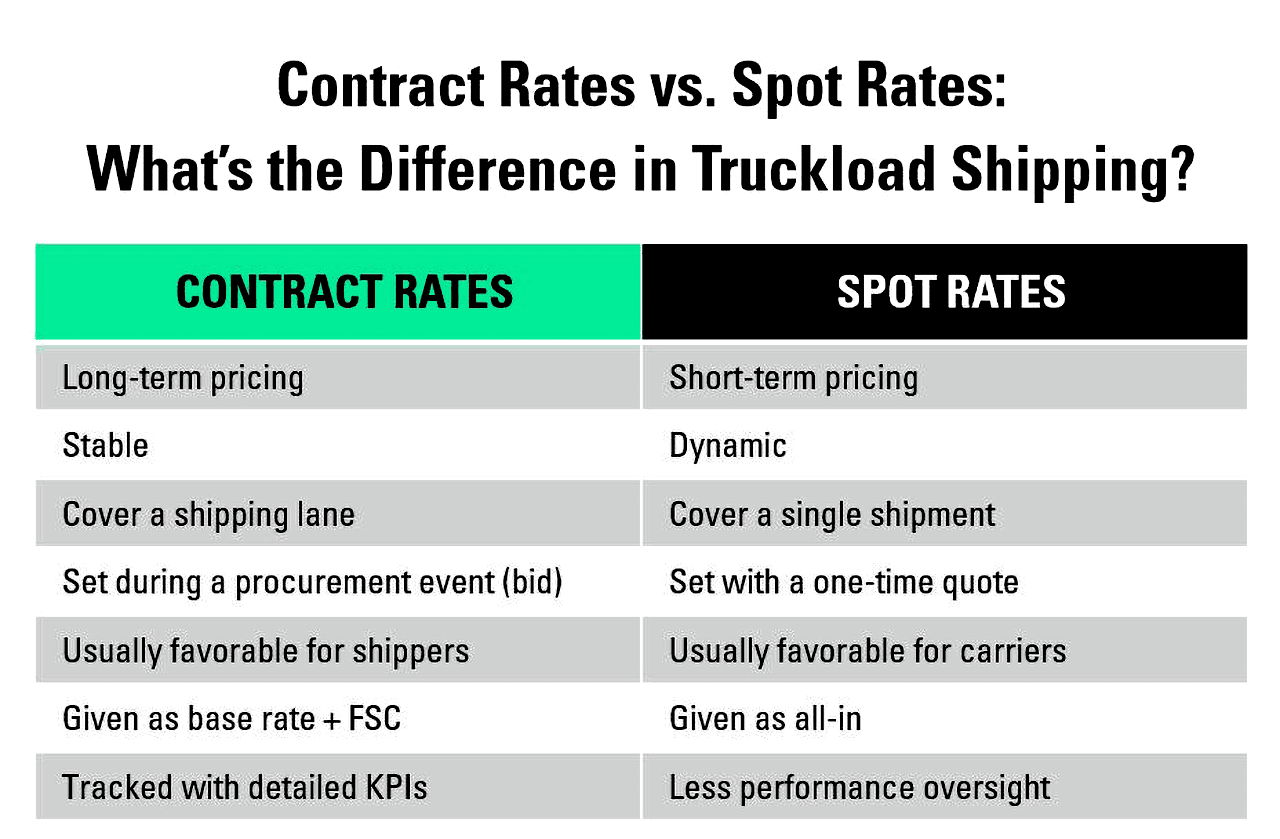

Here are the some key differences between the two:

What’s Cheaper: Contract Rates or Spot Rates?

At a high level, contract rates usually favor shippers, as carriers are more willing to negotiate on price in exchange for guaranteed, consistent freight volume (which means consistent revenue).

But that is not always the case.

It ultimately depends on the current state of the truckload market, the nature of your freight and your provider relationships.

Sometimes contract rates are higher than spot rates, sometimes they’re lower, and sometimes they’re the same.

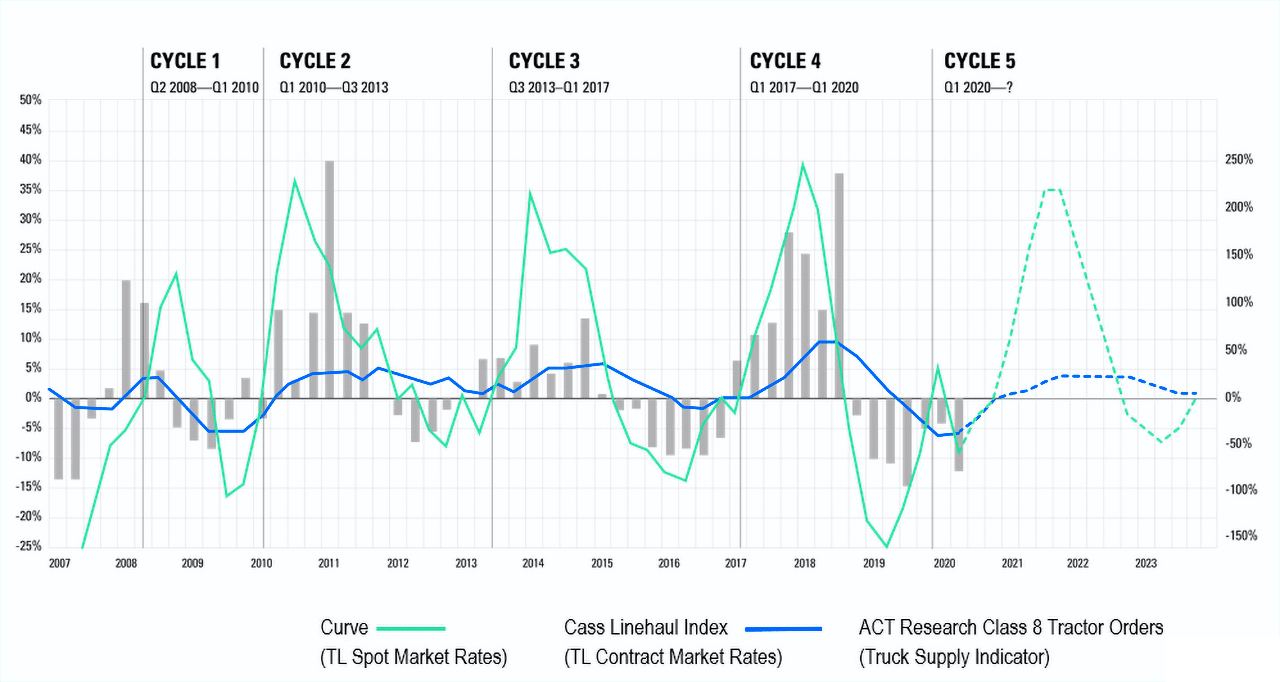

Why? The truckload market moves in cycles, and where we are in a cycle directly impacts pricing.

Shipper’s Market vs. Carrier’s Market

- In a shipper’s market, capacity is easy to secure and carrier competition for available loads is intense. In this environment, spot market rates are generally lower than contract rates.

- In a carrier’s market, capacity is tight and shipper competition for available drivers is intense. In this environment, spot market rates are generally higher than contract rates.

How Spot Rates Impact Contract Rates

Spot market activity in the three to six months leading up to a bid will heavily influence contract rate negotiations.

Look at the chart above: the blue contract index usually follows the lead of the green spot index after one to two quarters.

If spot market rates are inflationary, it will push up contract rates in the next bid. If they’re deflationary, it will usually keep rates stable, or potentially even drive year-over-year decreases.

Going Beyond Cost per Load

The key benefits of contract pricing are stability and predictability — for both rates and capacity, for both shippers and carriers.

It’s about taking a long-term view of supply chain strategy instead of trying to get the cheapest rate on every individual shipment.

How Much Freight Volume Do You Need to Get Contract Rates?

Any shipper can host a bid. If you’ve ever sent a rate request email to multiple carriers for the same load, you’ve technically had a transportation bid.

But what about a formal transportation RFP?

They’re not just for large companies moving hundreds of truckloads a day — many smaller shippers host bids to secure committed pricing too.

To request contract rates, you’ll need:

- Consistency in a shipping lane, or out of an origin point.

- A solid estimate of your load volume in each lane.

- The time frame you want the contract to cover.

That’s it. There is no set minimum shipment requirement. The success of your bid depends on the nature of your freight and if you can find a provider (or providers) whose network syncs with your opportunity.

If you have very low shipment volumes in a lane, contract pricing may not be the most cost-effective solution — the key is to check with your trusted providers, do some analysis, then decide what’s best for your business.

How Often Do Freight Shippers Renew Contract Freight Rates?

Most shippers host at least one procurement event per year to secure contracted capacity for their primary freight.

It’s rare to see truckload freight pricing for longer than one year, as the market tends to fluctuate too much.

These annual bids are usually held between Q4 and Q1, and will often include LTL and intermodal in addition to truckload.

Predictable Pricing, More Flexibility

Contract rates aren’t always for a full year.

Networks change. Some opportunities are seasonal or temporary. Shippers use other pricing tools to get the stability of predictable pricing, but with a little added flexibility.

Quarterly bids allow shippers to get new rates from their providers every few months instead of having a fixed rate on file for an entire year.

Mini-bids, which can occur as frequently as every month, are more dynamic and responsive to current market conditions, providing carriers competitive rates while simultaneously offering shippers reliable capacity.

Both of these tools are also effective for lower-volume shippers. If you do not have enough freight density to get an annual rate commitment, you may be able to secure quarterly or monthly terms.

There are 3 basic types of contract freight pricing:

1. Annual bids (once per year).

2. Quarterly bids (once per quarter).

3. Mini-bids (often monthly).

What Do Shippers Need to Host a Transportation RFP?

Whether you’re going to host an full annual network bid or a mini-bid with just a few providers, you will need to have a few things together first.

These 7 steps for a better RFP will help you set a solid foundation and guide you through the full process.

Freight Details You’ll Need

The more you can tell your providers about your freight, the more reliable rates and capacity you will get. At the very least, you will need the following information:

- Commodity type(s)

- Weight per load

- Cargo value

- Estimated shipping volume for each lane

- Origin and destination zip codes for each lane

- Shipment frequency for each lane

- Key performance indicators (KPIs)

- Special load requirements (accessorials)

- Fuel Surcharge

Freight Technology You’ll Need to Host a Bid

Regardless of size, every shipper needs a centralized way to track and store supply chain data, including procurement information — provider names, freight volumes, awards and lanes.

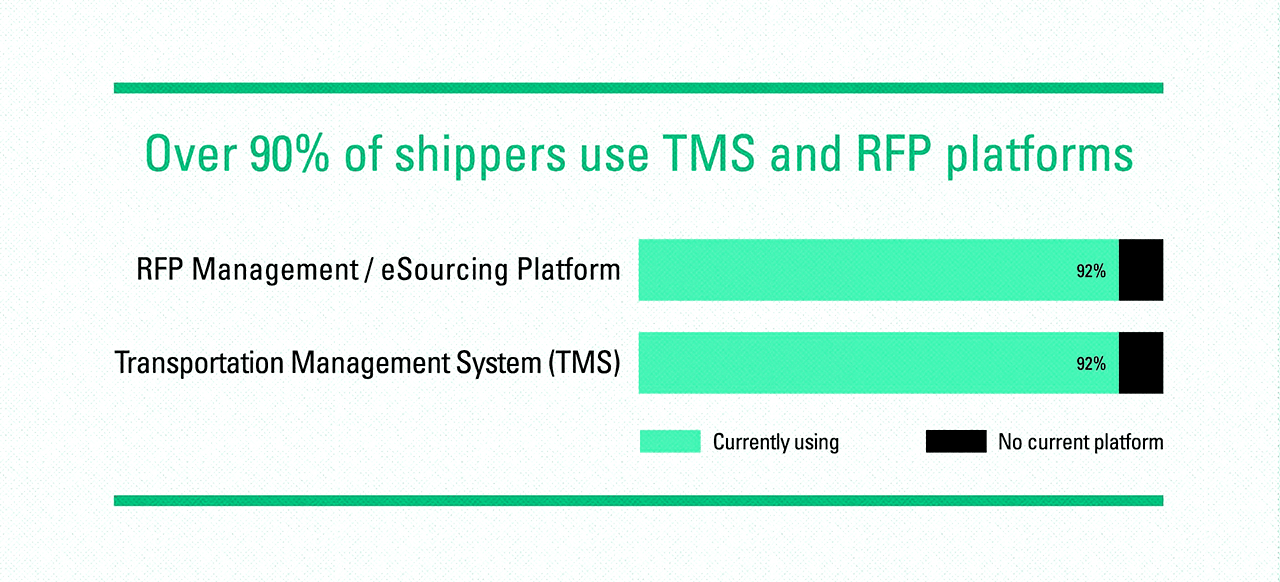

90% of shippers use digital platforms, like an integrated transportation management system (TMS). Many will also use a specific procurement tool.

If you’re a smaller business moving a few loads per week, a TMS and/or a bid platform might be overkill.

Many smaller shippers rely on Excel spreadsheets, Google Docs, email, and their providers’ technology platforms to manage RFP data.

Whatever is right for your business, it’s crucial to maintain a well-documented record that you can easily reference.

Related: Find out how this manufacturer upgraded their supply chain with the help of a TMS platform and a more comprehensive bidding process.

What About the Cost of Fuel?

Fuel accounts for ~30% of a carrier’s overall operating expenses and its cost can be volatile, sometimes fluctuating dramatically over the course of a year.

It would be impossible for carriers to accurately predict their long-term costs if they couldn’t account for changes in diesel prices.

To create sustainable long-term pricing, contract rates are always given as a base rate + fuel surcharge (FSC).

The fuel surcharge is determined by a matrix, or schedule. For each potential diesel price, there is a standardized percentage of the total rate.

It is important to establish your own FSC and communicate it with your providers before conducting a bid. This will help you get consistent, accurate rates.

What Happens If a Carrier or Shipper Breaks a Contract?

While contract rates are supposed to create a mutually beneficial scenario, it doesn’t always work out that way.

- Sometimes providers decline tenders, miss KPIs, cannot handle freight volumes, or need to renegotiate rates before the next bid.

- Sometimes shippers change their network or have lower-than-expected freight volumes.

For both shippers and carriers, breaking a contract can result in fines — every situation is different, but this is not usually the case.

The most common consequence for carriers is a dissatisfied customer and disqualification from future bid opportunities.

For shippers, it’s damaged carrier relationships, less reliable capacity and higher rates on the next bid.